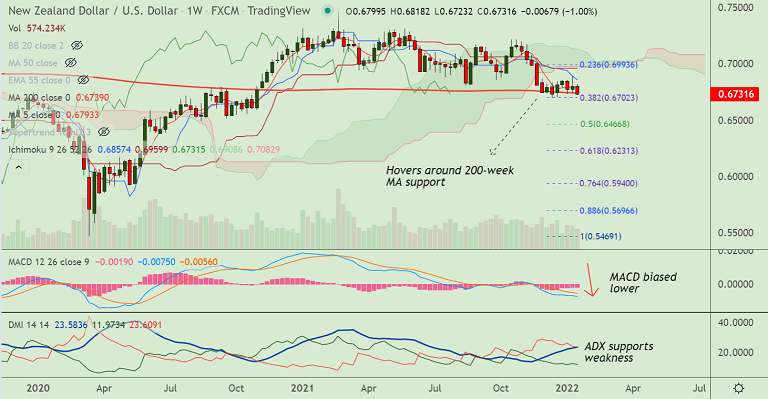

Chart - Courtesy Trading View

NZD/USD was trading 0.34% lower on the day at 0.6731, extends previous session's weakness.

The pair has slipped below 200-week MA and decisive close below will open downside.

The global risk sentiment took a hit early Friday amid expectations that the Fed will tighten its policy at a faster pace than anticipated.

Markets have fully priced in an eventual Fed lift-off in March and a total of four hikes in 2022.

Major focus remains on the FOMC monetary policy meeting on January 25-26 for clearer signals about the likely timing for rate hikes.

NZD/USD has resumed weakness after rejection at daily cloud. Momentum studies are bearish, stochs and RSI are sharply lower, MACD and ADX support downside.

Major Support Levels:

S1: 0.6702 (38.2% Fib)

S2: 0.6635 (Lower W BB)

S3: 0.66

Major Resistance Levels:

R1: 0.6739 (200-week MA)

R2: 0.6765 (5-DMA)

R3: 0.6789 (21-EMA)

Summary: NZD/USD trades with a bearish technical bias. Decisive close below 200-week MA will open downside in the pair. Scope for test of 0.6635 level.