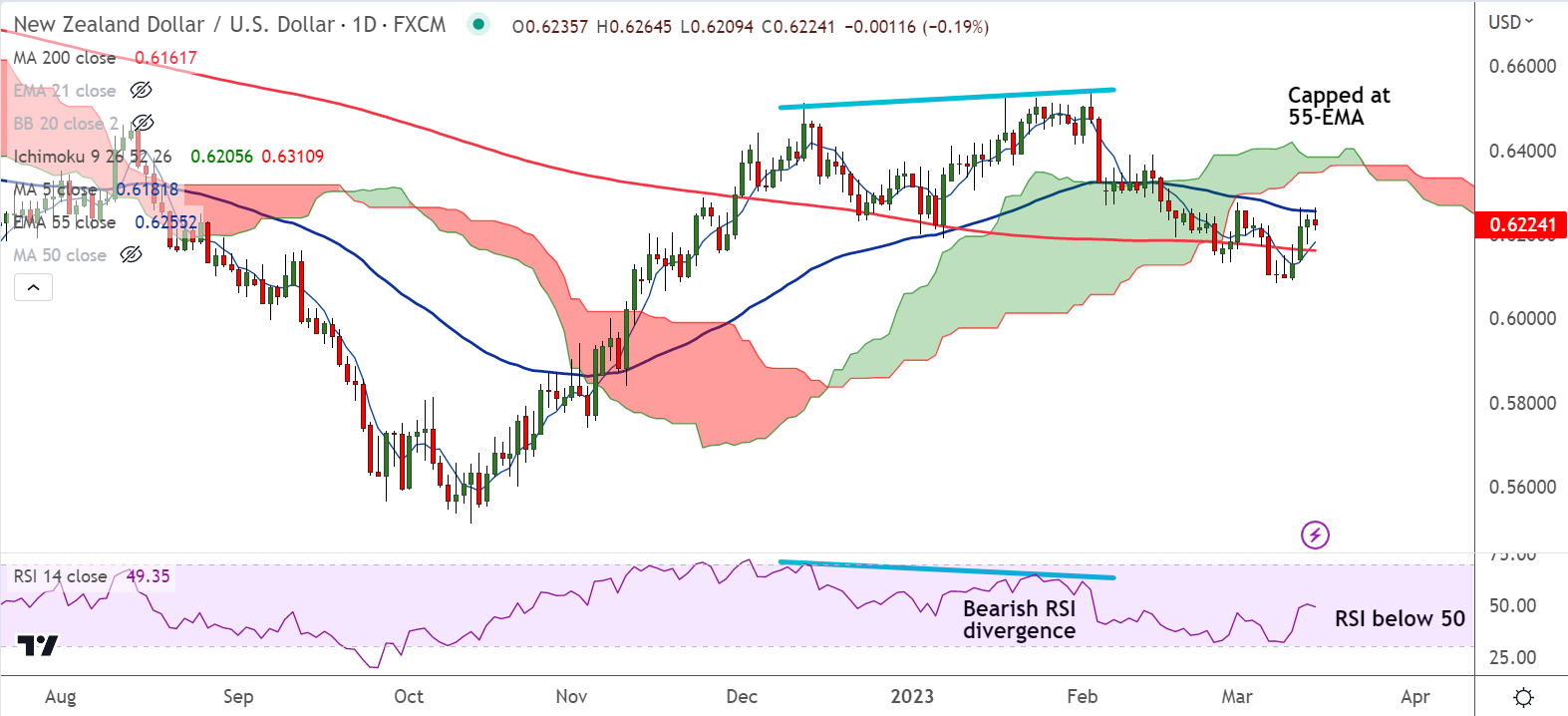

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.25% lower on the day at 0.6220 at around 06:45 GMT.

Previous Week's High/ Low: 0.6225/ 0.6084

Previous Session's High/ Low: 0.6247/ 0.6175

Fundamental Overview:

Data released earlier today showed China’s Industrial Production rose to 2.4% during January-February period, missing expectations at 2.6% and 1.3% prior.

Further, the Retail Sales came inline with forecasts at 3.5% during the stated period compared to -1.8% prior.

Earlier in the day, the People’s Bank of China (PBOC) held its one-year benchmark rate, namely the one-year Medium-term Lending Facility (MLF) rate, unchanged at 2.75%.

Further, US Consumer Price Index (CPI) and CPI ex Food and Energy matched 6.0% and 5.5% YoY market forecasts, versus 6.4% and 5.6% respective previous readings.

Focus now on US Retail Sales for February, expected -0.3% MoM versus 3.0% prior for intraday directions.

New Zealand Gross Domestic Product (GDP) (Q4) will also be in focus for fresh direction. New Zealand economy is set to have contracted by 0.2% vs. a growth of 2.0% witnessed in Q3. The annual GDP (Q4) likely expanded by 3.3%, lower than the prior expansion of 6.4%.

A weak GDP growth rate might delight Reserve Bank of New Zealand (RBNZ) policymakers as inflationary pressures could come down ahead.

Technical Analysis:

- NZD/USD extends sideways below 55-EMA resistance

- The pair is consolidating retrace above 200-DMA

- GMMA indicator shows major trend remains neutral

- Price action is above 200H MA, but RSI strength lacking

Major Support and Resistance Levels:

Support - 0.6161 (200-DMA), Resistance - 0.6255 (55-EMA)

Summary: NZD/USD struggles for direction below 55-EMA. Bulls lack upside conviction. Decisive break above 55-EMA could change near-term bias.