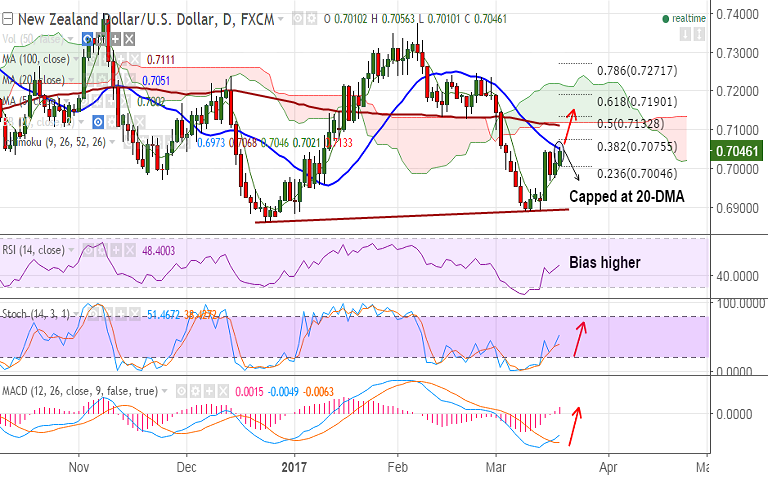

- NZD/USD is struggling to extend gains above 20-DMA at 0.7051, intraday bias higher.

- Technical studies are biased higher, we see scope for test of 100-DMA at 0.7111.

- Bullish invalidation only on close below 5-DMA, test of 0.6916 (50% Fib of 0.6347 to 0.7485 rally) likely.

- NZ GlobalDairyTrade price auction, scheduled to be held later today will be a major driver for price action.

- Focus shall be on Reserve Bank of New Zealand’s (RBNZ) monetary policy decision, scheduled on March 22.

Support levels - 0.70 (5-DMA), 0.6975 (Mar 17 low), 0.6916 (50% Fib)

Resistance levels - 0.7051 (20-DMA), 0.7075 (38.2% Fib retrace of 0.7375 to 0.6890 fall), 0.7111 (100-DMA)

TIME TREND INDEX OB/OS INDEX

1H Bullish Neutral

4H Bullish Neutral

1D Bullish Neutral

1W Neutral Neutral

Recommendation: Good to go long on breakout above 20-DMA at 0.7051, SL: 0.70, TP: 0.7080/ 0.71/ 0.7150

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 143.812(Highly bullish), while Hourly USD Spot Index was at -117.213 (Highly bearish) at 0630 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.