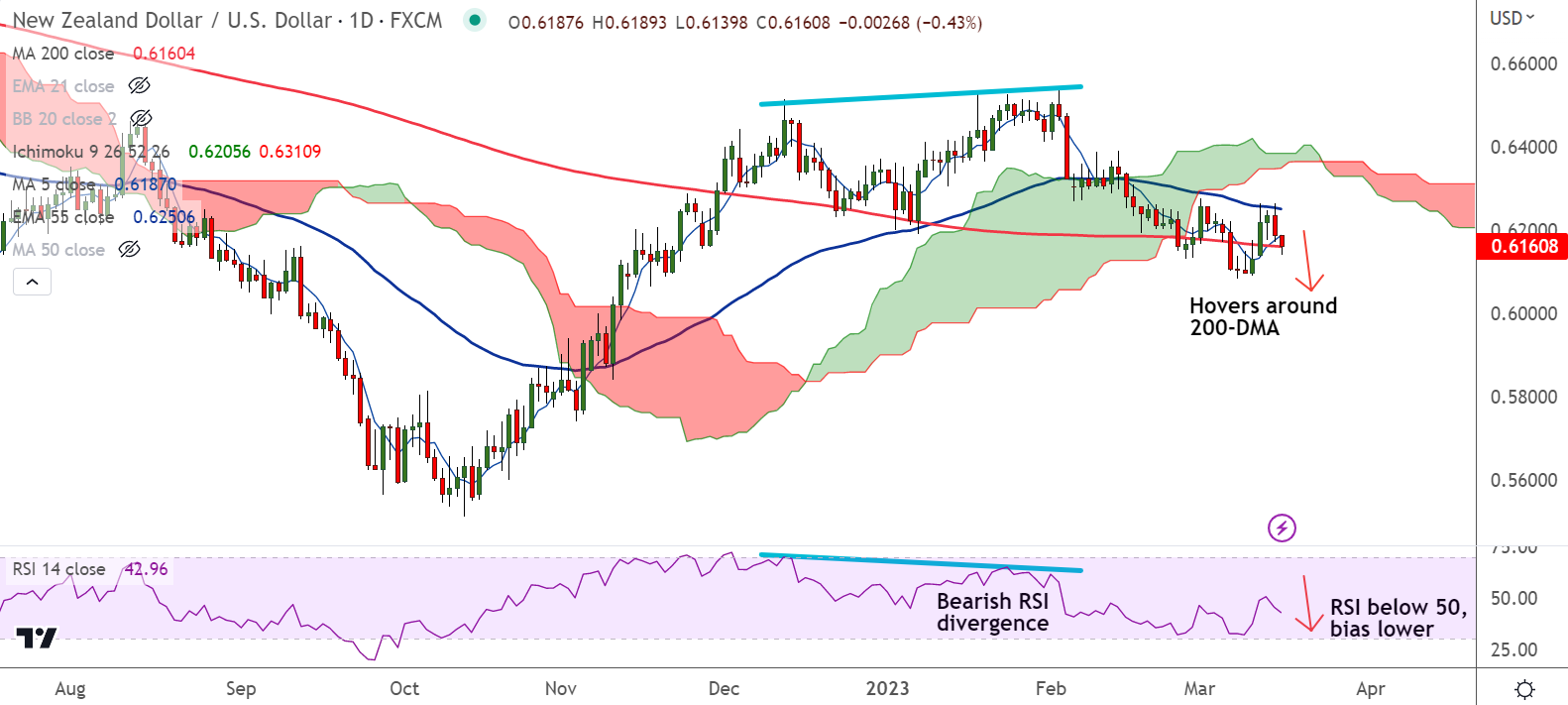

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.36% lower on the day at 0.6165 at around 05:55 GMT.

Previous Week's High/ Low: 0.6225/ 0.6084

Previous Session's High/ Low: 0.6264/ 0.6172

Fundamental Overview:

Fears emanating from the latest bank fallouts in the US and Europe sent investors fleeing from riskier assets like the kiwi.

The New Zealand dollar takes an added hit from data showing the New Zealand economy contracted by a surprisingly sharp 0.6% in the December quarter.

Further, the YoY figures also eased to 2.2% compared to the 3.3% expected and 6.4% in previous readings.

Softer-than-expected GDP data raised fears of New Zealand credit rating cut, weighing further on the kiwi.

The poor result only reinforced the market move to pricing in fewer rate hikes from the Reserve Bank of New Zealand (RBNZ).

Swaps now implied a quarter-point hike in April was a 50-50 chance, compared to an absolute certainty a week ago.

Technical Analysis:

- NZD/USD rejected at 55-EMA, extends weakness for the 2nd straight session

- Price action is below cloud and Chikou span is biased lower

- RSI is below 50 mark and biased lower, volatility is low

- GMMA indicator has turned bearish on the intraday charts

Support Levels:

S1: 0.6160 (200-DMA)

S2: 0.6093 (Lower BB)

Resistance Levels:

R1: 0.6189 (converged 5 and 20 DMA)

R2: 0.6206 (21-EMA)

Summary: NZD/USD pivotal at 200-DMA support. Decisive break below will drag the pair lower. On the flipside, bounce off 200-DMA will see sideways grind in the pair for the next few sessions.