- NZD/USD trades a narrow range into the European session.

- The pair finds major resistance around 0.7166 levels which is nearly converged 5&20-day MAs.

- Kiwi failed to benefit from strong gains seen in its OZ counterpart after upbeat Australia CPI data.

- Monetary policy divergence between the Fed and RBNZ also continues to dampen the sentiment behind the NZD.

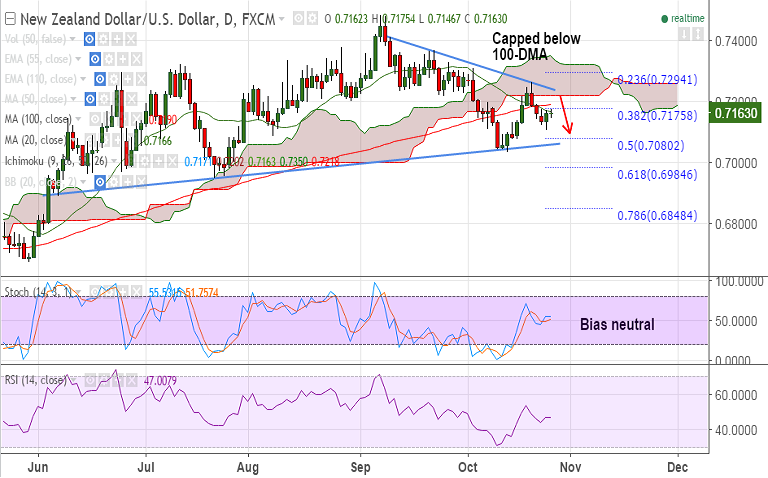

- Price action is well below daily cloud and 100-DMA is major resistance on the upside.

- Major support levels - 0.7109 (Oct 7 low), 0.7080 (50% Fib), 0.7060 (trendline), 0.7035 (Oct 13 low)

- Major resistance levels - 0.7166 (converged 5&20 DMA), 0.7175 (38.2% Fib), 0.7188 (100-DMA)

Recommendation: Good to sell rallies around 0.7160, SL: 0.7220, TP: 0.7135/ 0.71/ 0.7080/ 0.7040