- Natural gas breaks the pschycpsychologicaltance around $3 and jumped till $3.09.It has closed at $2.965.

- The commodity has once again risen back towards $3 on Monday, holding near a 20- month high. It is currently trading around 2.998.

- The commodity has broken above $3 (Jul 1st 2016 high) due to speculative buying. Historic heat has caused record demand for natural gas at gas-fired electricity to power air conditioning.

- The Farmer’s Almanac is forecasting more cold winter for the lower 48 United States. It has good track record for their Long term weather forecast.

- If the forecast comes true then chance of changing from Natural Gas storage surplus to storage shortage is high.

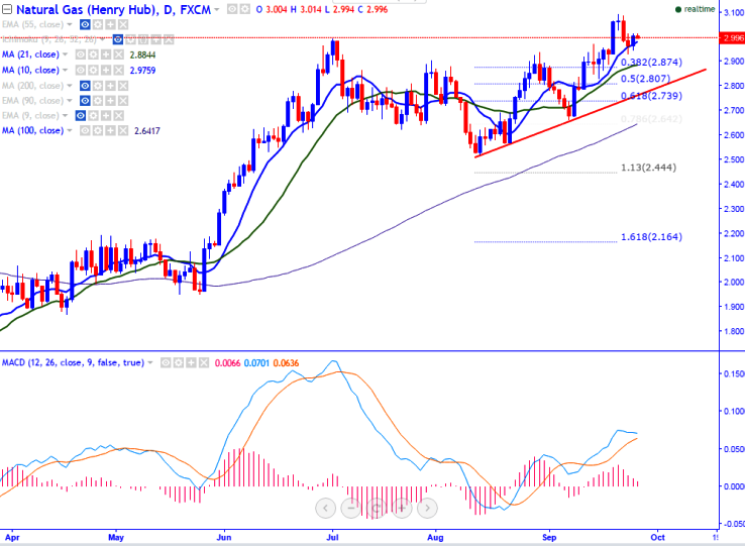

- Technically any continuous close above $3 will confirm major bullishness, a jump till $3.28 (161.8% retracement of $2.993 and $2.523)/$3.35 is possible.

- On the lower side , $2.870 (21- day MA) will be acting as short term support and any violation below targets $2.739 (61.8% retracement of $2.519 and $3.094)/$2.670.

It is good to buy on dips around $2.990 with SL around $2.87 for the TP of $3.30/$3.35.