Nikkei recovered slightly following the footsteps of US markets. It hit a low of 35116 yesterday and is currently trading around 36228.

The Japanese index was one of the worst performers the previous week on Yen strength. It gained strongly against all majors as recession fears have increased demand for safe-haven assets.

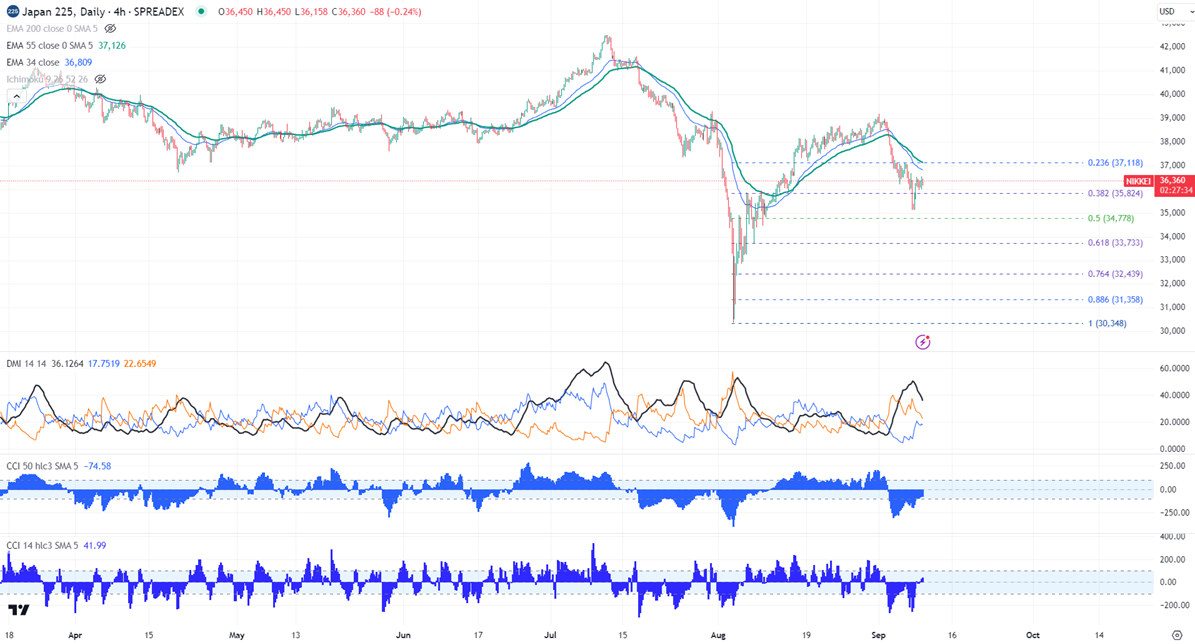

The index holds below short term (34 and 55 EMA) and long-term moving average (200- EMA) in 4 hour chart.

The near-term resistance is around 36600, any violation above will take the index to 37147 (50% fib)/ 37500/37695/38000. Overall bullish continuation only above 42550.

On the lower side, immediate support stands around 36000, any breach below will drag the index down to 35635/35000.

Indicator (4- hour chart)

CCI (14)- Bearish

CCI (50)- Bullish

Average directional movement Index - Neutral

It is good to sell on rallies around 37100-120 with SL around 37500 for TP of 35000.