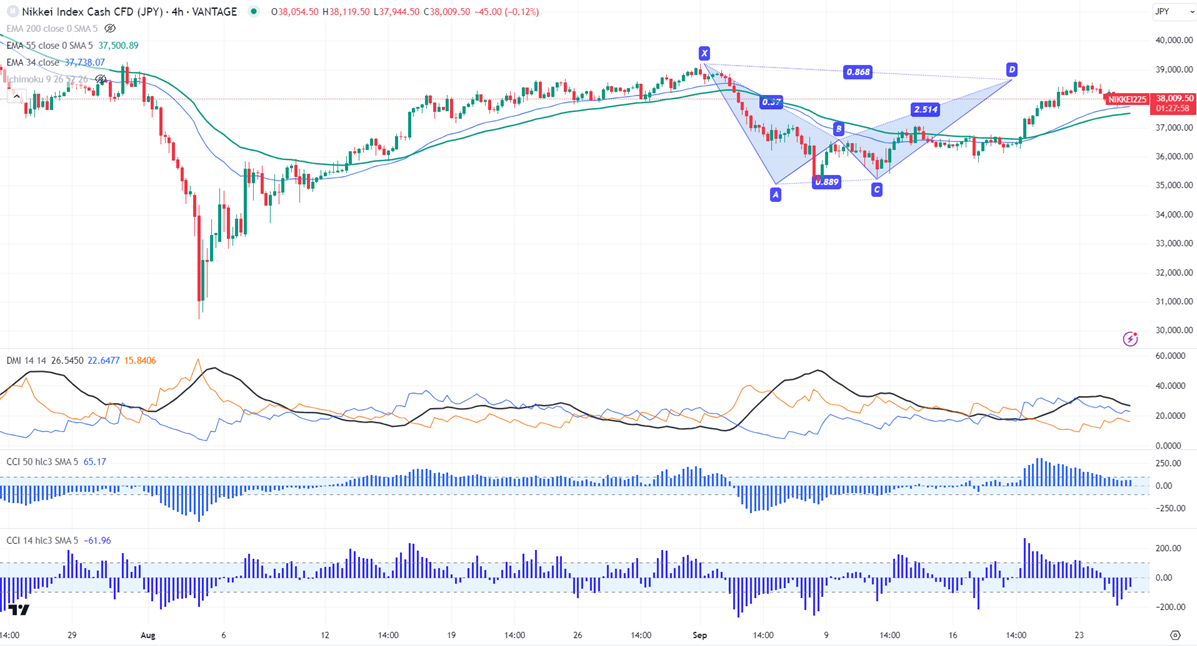

Harmonic pattern- Bearish BAT pattern

Potential Reversal Zone (PRZ)- 39200

Nikkei pared some of its gains due to profit booking. It hits a low of 37660 yesterday and is currently trading around 38009.

he index holds above short-term 34 and 55 EMA and long-term moving averages (200- EMA) in the 4-hour chart.

The near-term resistance is around 38700, any violation above will take the index to 39000/39200/39500/40000—overall bullish continuation only above 42550.

On the lower side, immediate support stands around 37800, any breach below will drag the index down to 37500/37200/37000/36800—further bearishness only below 35000.

Indicator (4- hour chart)

CCI (14)- Bearish

CCI (50)- Bullish

Average directional movement Index - Neutral

It is good to sell on rallies around 38480-500 with SL around 39000 for TP of 36800.