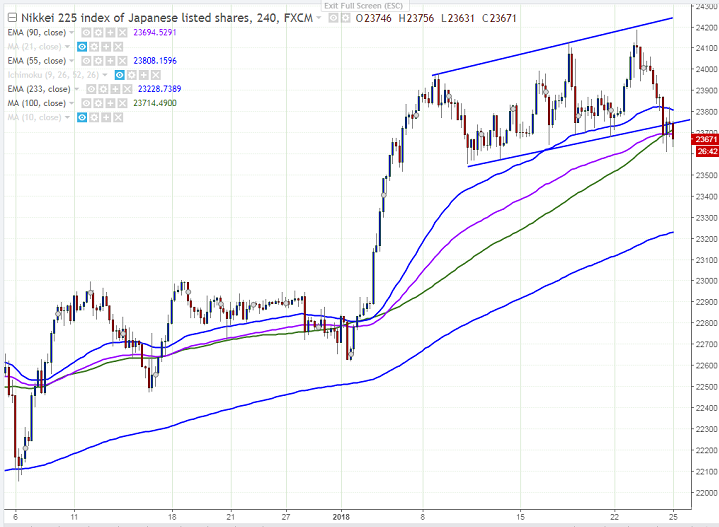

- Nikkei has shown a minor decline of almost 500 points after hitting high of 24122. The major reason for slight decline was due to huge sell off in USD/JPY pair. US S&P 500 has shown a minor sell-off from the all-time high of 2852. It is currently trading around 23656 0.40% lower.

- USD/JPY has declined almost 100 pips yesterday from the intraday high of 110.33. The pair dipped till 108.96. it is currently trading around 109.02. The near term resistance is around 109.50 and any break above will take the pair to next level till 110/110.35.

- On the lower side, index major support is around 23600 and any break below will drag the index down till 23200/23000.

- The near term resistance is around 23850 (233- 4H MA) and any break above will take the index to next level till 24000/24200.

It is good to buy on dips around 23750-800 with SL at 23500 for the TP of 24200/24480.