Nikkei is trading higher and jumped more than 500 points yesterday on US-China trade deal optimism and weak yen. The US 10 year bond yield has shown a nice recovery of more than 7% from yesterday close 1.472%d recovered more than 6% and spread between the US-10 year and 2-year has widened from - 5 bps to +2.9 bps. The index hits high of 21269 and is currently trading around 21222.

US Market- The Wall Street has closed higher with Dow Jones and S&P500 26728 (1.41%) and 2976 (1.30%).

Japanese Yen- USDJPY is trading higher and holds well above 107 level a jump till 108 likely.

Shanghai composite- Shanghai has shown a minor profit booking after a jump of more than 4.5% in the past four days. Any break above 3045 confirms major trend reversal and a jump till 3100/3200 likely.

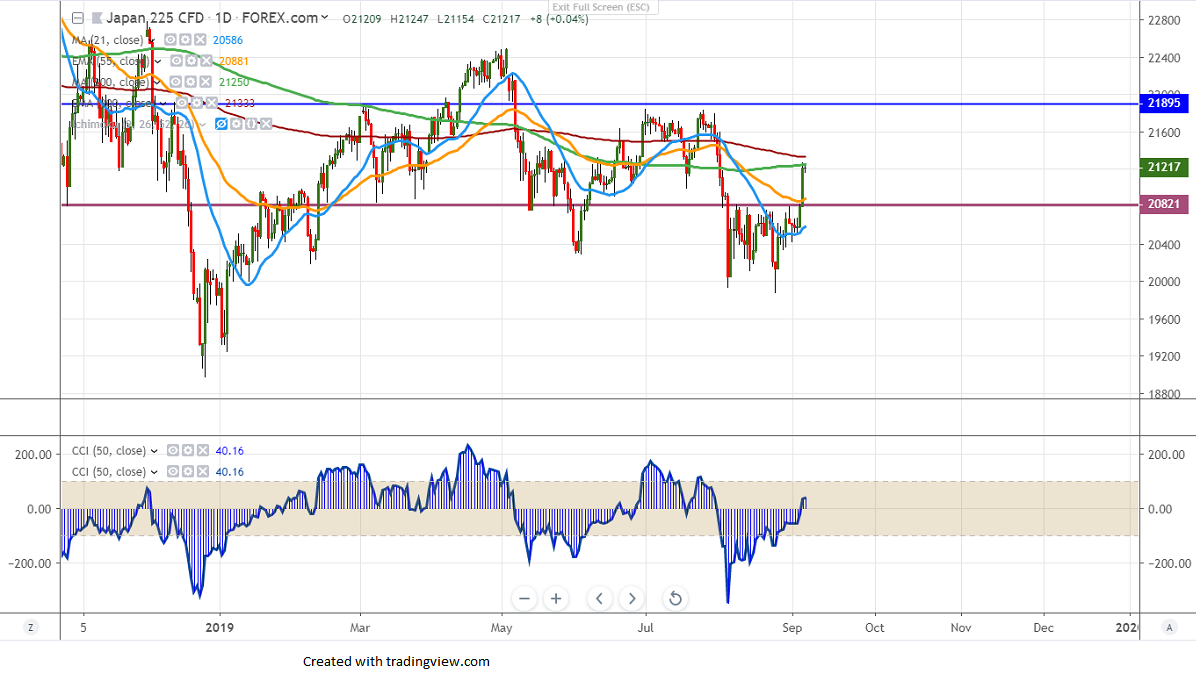

Technically Nikkei facing near term resistance around 21250-350 and any minor jump can be seen only if it closes above this level. Any close above targets 21500/22000.

On the flip side, near term support is around 20840 and any violation below this level will take the index till 20500/20190.

It is good to buy on dips around 21000 with SL around 20800 for the TP of 21500.