- Nikkei has declined once again after showing a minor recovery till 19482 on account of stronger yen and global equities sell –off. The political uncertainty in North Korea has increased demand for safe haven assets like Gold, Yen and Swiss franc.

- The Japanese shares is declining from Aug 29th after the North Korea missile launch followed by nuclear test on Sep 3rd 2017. Nikkei is currently trading around 19252 0.80% lower.

- USD/JPY is trading weak and has broken major support 108. It is currently trading around 10770. The minor bullishness can be seen only above 110.67. Any break above will take the pair till 111.17/112.The major short term support is around 108 and any break below targets 106.

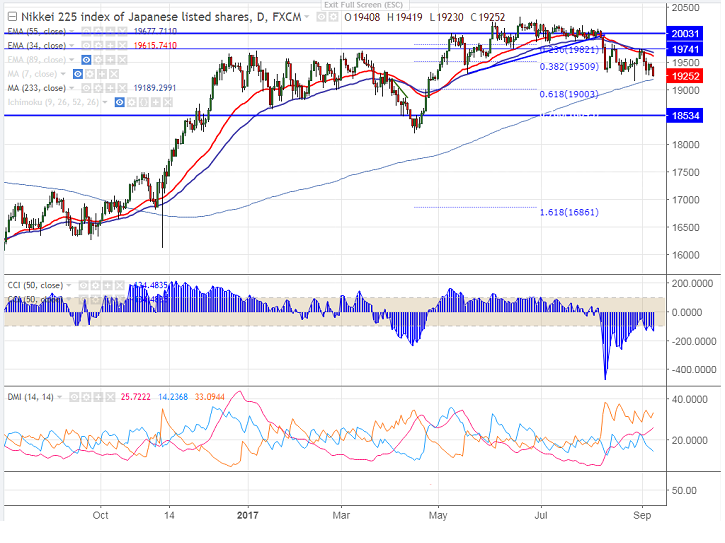

- On the lower side, index major support is around 19 (200-day MA) and any daily close below will drag the index down till 19144/19000 (61.8% retracement of 18193 and 20319)/18500.

- The near term resistance of Nikkei is around 19745 (100- day MA) and break above will take the index to 19798 (cloud bottom)/20000/20319 (Jun 20th 2017).Short term bullish invalidation only below 19145.

It is good to sell on rallies around 19450-500 with SL around 19750 for the TP of 19000.