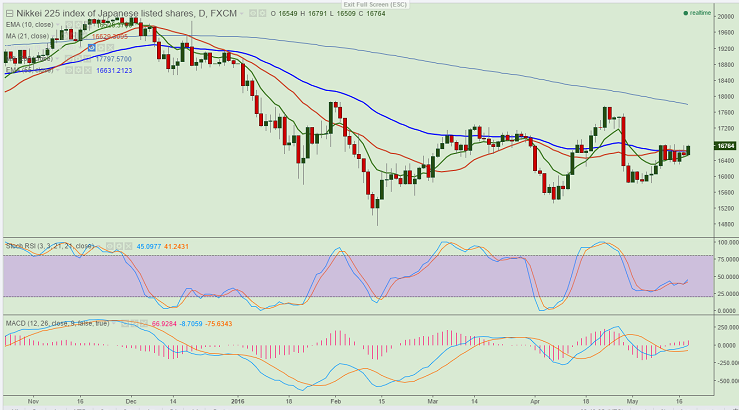

- Major resistance - 16985 (11 May High)

- Major support - 16470 (10 day EMA)

- Nikkei index has slightly retreated after making a high of 16790. It is currently trading around 16759.

- Short term trend is slightly bullish as long as support 16470 holds.

- The index major resistance is around 16800 and any break above will take the index to next level 17000/17300/17525.

- On the lower side major support is around 16470 (10 day EMA) and break below will drag the index down till 16350/16000/15800 in short term.The minor support is at 16500.

- Short term trend reversal can be seen only below 15000.

It is good to buy at dips around 16650 with SL around 16450 for the TP of 16800/17000./17300