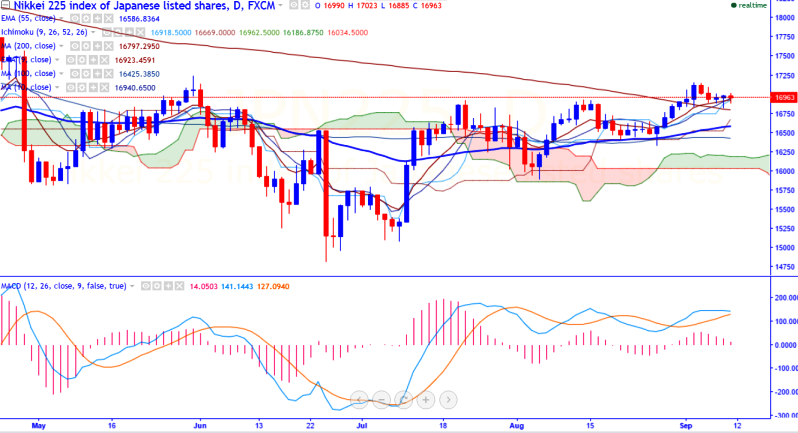

- Major support -16820 (200- day MA).

- Nikkei225 has once again recovered from 200- day MA till 17023 at the time of writing.It is currently trading around 16958.

- The index has formed temporary top around 17159 and is struggling to break is facing strong resistance at 17200 and any break above confirms further bullishness , a jump till 17330/17500 can be seen.

- Short term trend is slightly bullish as long as the index not able to break below 16820 (200-day MA).

- On the lower side, any break below major intraday support 16820 (200-day MA) and any break below 16820 will drag the pair till 16525 (daily Kijun-Sen)/16400.

It is good to buy on dips around 16825 with SL 16600 for the TP of 17000/17200