Before we begin with hedging frameworks, refer below web-link for our technicals trend analysis:

We kept uttering for bearish trend of this pair, although it took a rally in mid of this month when it reached 86.379 bears have been active again. No question of speculating this bearish pressure, instead foreign traders are advised to stay hedged their FX exposure in this pair.

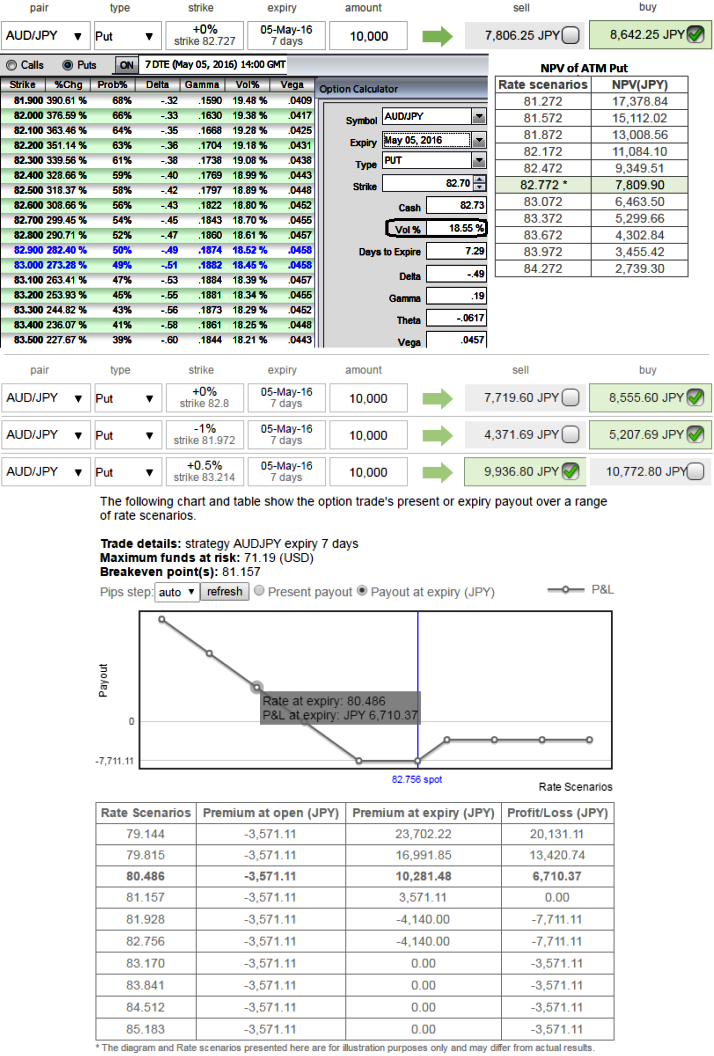

As shown in the diagram, the ATM IVs of AUDJPY of 1W expiry is at around 18.55%.

While, 1W ATM puts are priced 10.66% more than Net Present Value.

Sensitivity tool signals more positive change in premiums in OTM strikes scenarios.

Thereby, one can initiate trading or hedging strategy using OTM puts which would be even more cheaper.

Well, on hedging grounds, Put ratio Back Spreads are advocated.

Because, the trend signalling bearish risks after breaking 84.001 levels with favourable bearish signals by technical indicators as explained in technical write up, and secondly, the traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 1 lot of at the money -0.49 delta put, 1 lot of 2M (1%) out of the money -0.37 delta put and sell 1W one lot of (0.5%) In-The-Money put option.