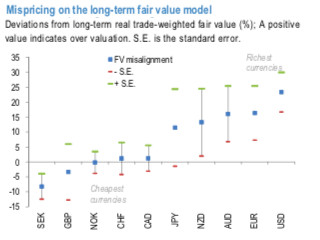

There has been substantial FX market moves over the past month and this has led to some changes in the ranking of currencies on this framework. On the cheaper end of the spectrum, following SEK’s notable underperformance over this period, SEK now screens as the cheapest currency on this framework. Meanwhile, GBP outperformance over the same period has nudged the currency closer to fair value (refer 1st chart). While GBP valuations are not at an extreme yet, SEK’s undershooting is now approaching decade-lows and may indicate some limits to how much recent underperformance can extend (refer 2nd chart).

The ranking is relatively unchanged on the rich end of the spectrum, with USD, EUR and the Antipodean FX still featuring on that list. Among the funding currencies, CHF is the only one near fair value, with USD the richest, followed by EUR and JPY. Yet, None of these valuations are at an extreme indicating that movement in either direction is possible.

While the richness of the Antipodean FX has come off the peak, both AUD and NZD continue to look overvalued relative to the G10 petro-FX. Both NOK and CAD continue to be near fair value on this framework (refer 3rd chart).

Despite the recent weakening, USD continues to screen 19% rich on the framework, keeping it the richest G10 currency on a cross-sectional basis. Current mispricing indicates two-way risks to the currency. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -81 levels (which is bearish), hourly USD is at 55 (bullish), hourly AUD spot index was at 9 (neutral) and NZD is 140 (bullish) while articulating at (09:43 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty