Well, well well..!!! It's minting profits for those who executed our strategy (put backspreads) in the recent past, a miracle for rest all set of EURAUD trading community.

Before proceeding further we would like you to refer our previous article by following below link,

http://www.econotimes.com/FxWirePro-Doji-on-channel-line-breach-signifies-EUR-AUD-potential-slumps-%E2%80%93-OTM-shorts-on-job-yields-of-longs-on-table-92883

Hasn't it been great to know the prevailing price after reading the above recommendation..? The underlying exchange rate of EURAUD has been tumbling from 24th September. The current spot ticker of this pair is 1.5882.

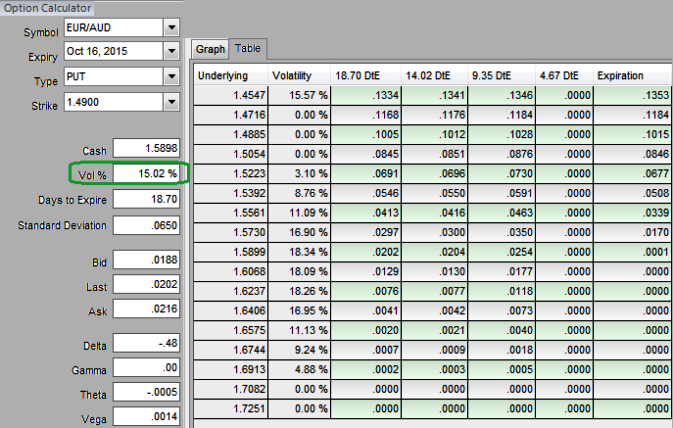

More importantly, IV is also inching higher which means the market reckons the price has potential for large movement in either direction but no worries when we say either direction, it would indeed be southwards as per our technical signals.

Options with a higher IV cost more (see IV in the diagram and compare the same with previous post). This is intuitive due to the higher likelihood of the market 'swinging' in your favour. IV increases to 15% and we are holding 2 lots of longs on ITM strike vega put with 15D expiry, this is good news for option holders. Vega in a back spread is generally dominated by the long options the more time there is to expiration and the closer EURAUD is to the strike price of the long options.

Overall in general, our longs are pretty much working out with the current upswings.

FxWirePro: Now option holders’ turn after writers to derive certain profits on EUR/AUD PRBS

Monday, September 28, 2015 7:44 AM UTC

Editor's Picks

- Market Data

Most Popular