Technical glimpse: Upon the formation of Gravestone Doji and shooting star patterns on weekly charts along with the healthy bearish convergence from leading and lagging indicators would divulge a better clarity of prevailing bearish trend and its sustenance.

Glance on Oil Fundaments:

We don’t think yesterday’s checks of the US crude inventory levels would not play any major role to prop up crude’s prices.

The long-awaited rebalancing of the global oil markets is at hand. Although oil inventories remain high globally, non-OPEC supply, led by declining US crude output, is falling.

Over the last six months, U.S. crude output has moved lower in 23 of the last 24 weeks to fall to its lowest level since May 2014. By comparison, weekly output in the U.S. eclipsed 9.4 million bpd 13 months ago, hitting its highest level in 44 years.

While U.S. output continues to fall at a rapid pace, OPEC production remains near all-time highs. Earlier this week, a Bloomberg survey showed that OPEC production increased by 240,000 bpd in June to 32.88 million bpd. For the month, production in Saudi Arabia surged 70,000 bpd to 10.33 million bpd, lingering near its highest level on record.

Option Strategy:

On the NYME, WTI crude for August delivery rose 1.09% to $45.63 a barrel.

Overnight, the prices of crude futures are plummeted to near two-month lows on Thursday after the lower than forecasted U.S. inventory that the conclusion of a prolonged downturn in oil prices is nowhere in sight.

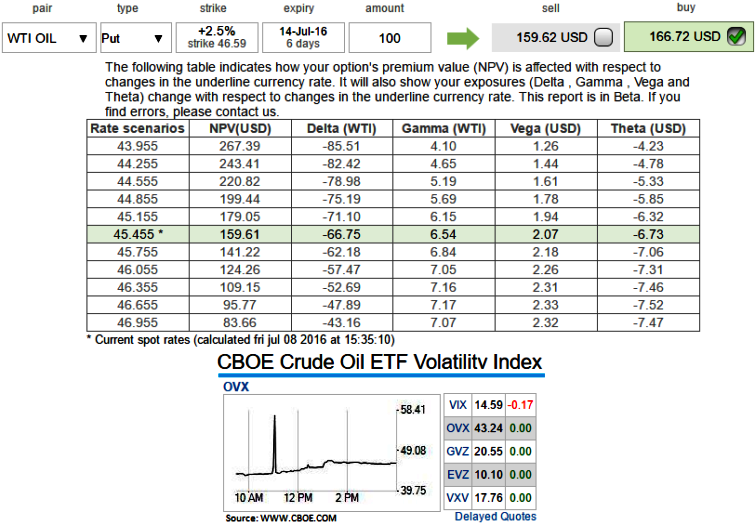

With the reasoning briefed above, this vertical bear put spread option trading strategy is employed when the options trader thinks that the price of the underlying WTI crude will fall reasonably but within a bracket of 2.5% downward range.

When we have 2.07 Vega on 1w (2.5%) In-The-Money put option which is trading at US$127, while CBOE crude oil volatility index by 0.17 to 14.59.

Always remember the FX option’s delta and vega would have the huge impact on a long put position should the market bounce.

So the recommendation would be “long vertical put spread” that will cuts down the exposure you have against dubious rallies in anyone’s mind, but more significantly it will also reduce the exposure you have to Vega, the relative effects of volatility on the option prices.

One way of minimizing the avid appetite a naked long put has for your precious capital is to spread much of the risk by using vertical spreads.

Hence, go long in 1m (2.5%) In-the-money put, while by shorting 2w (-2.5%) deep Out-Of-The-Money put with the same maturity so as to turn vega into correspondingly positive.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand