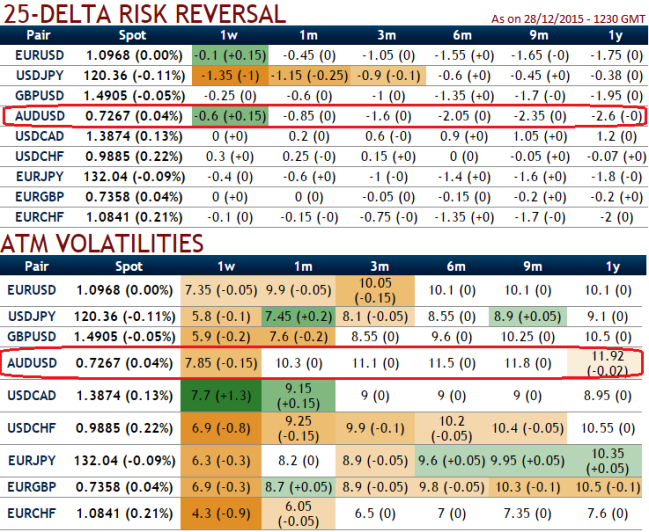

As you can make out from the diagram the implied volatility for near month at the money contracts of AUDUSD pair has been highest among G20 currency segment and is seen at 11.8-12% levels for 1m expiry.

We could still foresee the AUD biased lower over the next 3-6 months on the back of modest near term softness in commodity prices and Fed tightening (Q1 of 16 target USD 0.67) (see hedging markets positions in OTC markets over the period).

Before finding some support later in the year (Q4 of 16 target USD 0.70 back again) as the terms of trade trough and the domestic economy continues to rotate away from mining-related activity.

More importantly, for AUD, rate compression remains a bearish force for the currency, but in 2016 it will be driven by Fed hikes rather than RBA easing (we think the RBA is done).

The greatest difference, however, is the terms of trade, which we think is bottoming as iron ore prices move within a range and LNG exports rise, thus insulating the trade balance from higher oil prices next year.

Considering the above aspects we recommend deploying one touch binary puts in our strategy in order to extract leverage on extended profitability.

By employing debit vega spreads with 2M At-The-Money vega puts one can multiply returns by twice, thrice or even pour returns exponentially.

But on speculative grounds, use one touch binary vega puts, the prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch AUD/USD options are constant time and barrier levels.

Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times. You can see that in charts how every dips would propel Vega effects.

FxWirePro: OTC positions divulge forecasts of AUD/USD in Q1 and Q2

Tuesday, December 29, 2015 8:36 AM UTC

Editor's Picks

- Market Data

Most Popular