Buying interests are mounting in the safe-haven sentiments amid global slowdown which is still imminent. We are witnessing price slumps for the 2nd consecutive days in gold (XAUUSD). But bulls are accumulating and currently trading at around $1,499 an ounce (while articulating) upon intensified buying momentum on various driving forces.

Amid simmering geopolitical turmoil, on both sides of the Atlantic, although gold prices are little edgy today but largely shrugged, ending last week down 1.3%.

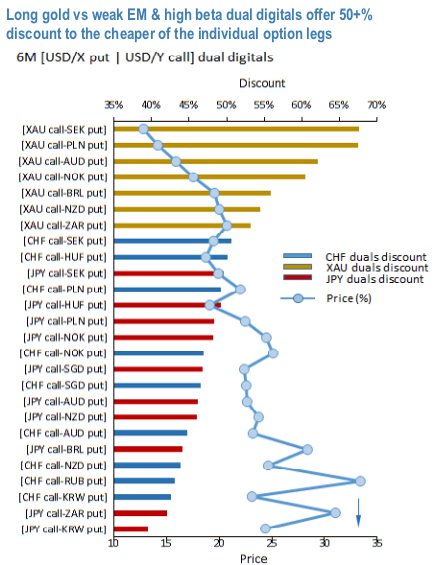

While simultaneous strength in reserve assets like gold, CHF and JPY is supportive of long correlation option structures the effect is already in the price, providing only marginal benefits for correlation structures (e.g. the dual digitals pairing stronger yen and stronger gold have only 24% discount built in). A qualitatively similar, but much less-explored alternative to CHF and JPY via options is Gold.

J.P. Morgan’s analysts in metals segment have been projecting a continued increase in XAUUSD spot to as much as $1,660 by 1Q 2020 even before this week’s impeachment news. The upside would be attractive to utilize as a hedge in form of standalone XAU calls if it was not for the vol pricing that has already run up to nearly 2-year high and prompts us to look for alternative leveraged structures.

On this front, we note that the template of narrow USD weakness against safe haven assets in the event of re-emergence of Washington risk premium in the dollar is unlikely to apply to cyclical commodity FX, and their correlation to JPY, CHF and gold is likely to weaken further. This can open up opportunities to exploit the correlation setup to structure (USD/X put, USD/Y call) dual digitals with X being safe haven asset and Y a high beta, vulnerable currency.

Gold based duals are reaping >55% discount and command the best pricing among various currency combinations along these lines (refer above chart).

Consider: 4M (XAUUSD > 1570 (5% OTM), AUDUSD < 0.67 (1% OTM)) dual digital @5.25/11.25%USD, spot reference: 1496 for gold and 0.676 for AUD. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential