In this write-up, we emphasize to explore the potential of trading live (non-delta hedged) FX options based on a well-known and broadly used FX cash trading technical indicator: stochastic oscillator index.

The prime objective is that stochastic indicator could trace out signs of slowing or reversals in trend that consequently can be capitalized via the rich universe of directional FX option structures.

This follows on the back of systematic work on:

a) FX spot trading and b) trading FX carry trading via options

The study the feasibility of directional currency investments with spot and/or options using joint signals from both markets. While those previous studies focused on lateral trading rules that select the best currency pairs (cash or options) to trade based on their rankings on certain attributes, the current study is a time-series analysis where a stochastic oscillator is used to time entry into directional vanilla options.

The stochastic oscillator is a momentum indicator that attempts to compare current prices relative to where prices have traded during a specific range over a rolling lookback period.

We consider G10 currency universe: (all 9 USD pairs) and EM (15 most liquid EM pairs: BRL, MXN, CLP, COP, SGD, CNH, INR, KRW, TWD, IDR, RUB, TRY, ZAR, PLN, and HUF) are analysed separately. The results suggest qualitatively similar benefits from using stochastic oscillator to time entry into G10 and EM options.

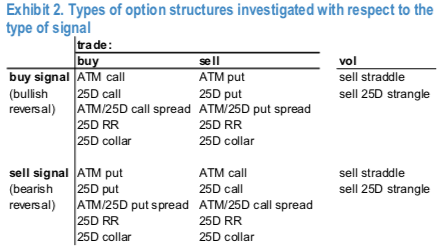

Options P/Ls: We cover a suite of option structures: 1) vanilla structures: ATM calls and puts, 25 delta calls and puts, and 25 delta risk reversals, and 2) multi-leg structures such as ATM/25 delta call/put spreads, 25 delta collars, straddles, and 25 delta strangles (for robustness we also test the key results against the equivalent option structures involving 10D options). While trade entry is timed, options (1M, 2M, and 3M tenor) are always held till expiry. No delta hedging. P/Ls represent payoff at expiry (net of initial cost).

The above table lists the option structures analysed. In principle, a bullish stochastic oscillator reversal (i.e., a “buy” signal) can be executed in options by either taking a long position in calls, a short position in puts, or both. The exact opposite holds for bearish reversal signals (“sell” signals).

Results: stochastic oscillator boosts FX options returns

The 1stto 3rdcharts exhibits cumulative returns (bps) for the 2006-2018 period across various structures. Returns represent total trading P/L from trading across G10 pairs. With respect to notional, trades are always entered at unit USD notional of the options for single legged structures and unit USD notional / leg of multi-legged ones.

One further clarification is needed. Long/short designation in 2ndand 3rdcharts refers to 1) for “calls,” “call spreads,” “R/Rs,” and “collars,” the trades are long option structures on “buy” signal (bullish reversal) and short option structures on “sell” signal (bearish reversal), while 2) for “puts” and “put spreads,” the trades are long the structures on “sell” signals and short the structures on “buy” signals. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 142 levels (which is bullish), while USD is flashing at 30 (which is bullish), while articulating at (14:09 GMT). For more details on the index, please refer below weblink:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation