We could foresee lot of speculations happening around USDJPY currency cross.

Despite last week's preliminary Q/Q GDP in U.S. posted upbeat numbers at 2.1% which is an increase from previous 1.5% and trade deficit has been contracted from previous 59.1B to 58.4B, dollar has been adversely reacting to these fundamental indicators.

This lackluster move is confirmed by the sluggish consumer confidence numbers (reported at 90.4 versus previous 99.1).

On the flip side, Japan reported healthy retail sales numbers at 1.8% versus previous -0.1%.

While industrial production is also improving from 1.1% to 1.4%.

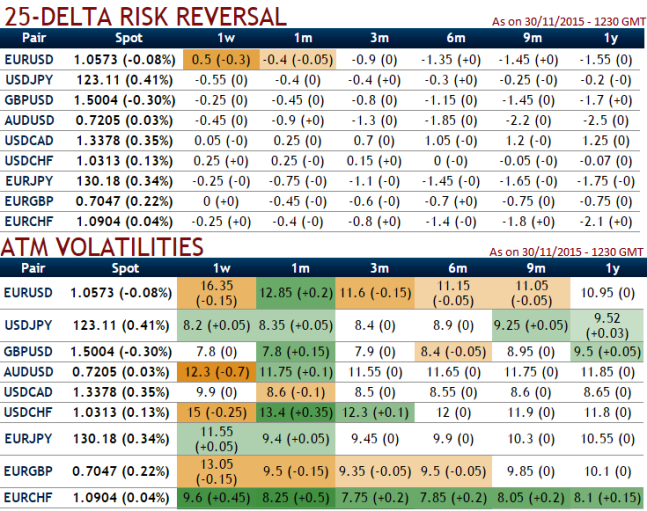

Delta risk reversals of USDJPY for next 1-3month: The OTC options market appears to be more balanced on the downward direction for this pair over the 1-3-6m time horizon and as a result delta risk reversal for USDJPY was turning into slightly negative, thereafter dollar rebounds as per delta risk reversal computation coupled with recent booming economic numbers of U.S.

We don't see any reasons to short dollar but short term corrections up to 121.991 (23.6% fibo levels).

So, short ITM put with 2D expiry since implied volatility is inching higher which is good for option writers and buy 2 lots of ATM and OTM put with 10D expiries.

With dollar index (DXY) approaching the psychological barrier of 100.0 may also weigh, it is also understood that ATM contacts of USDJPY are gradually reducing implied volatilities (second least IVs which is good for option holders) ahead of much awaited fed's meet which is underway that could prop up market speculations again (see current 1w & 1m contracts).

We've combined positions with buying at the money and out of the money puts and, simultaneously, shorting an in the money put as well, these in the money puts are always at risk of exercise, but you have two advantages.

First, assignment can be covered by the long puts; second, time decay and implied volatility work in your favor on the short puts.

This points out the importance of entering the position when implied volatility is higher than average.

FxWirePro: Placing Put Ratio Back Spreads in USD/JPY’s puzzling swings mitigates downside risks

Tuesday, December 1, 2015 8:48 AM UTC

Editor's Picks

- Market Data

Most Popular