The Bank of Canada is scheduled for its monetary policy meeting today, and most likely to maintain the status quo to leave its key rate unchanged. There would be no surprises on that front.

However, that does not mean that CAD traders can sit back and relax today. As is often the case the devil is in the detail: will the BoC stick to its view that further gradual rate hikes will be necessary for the future despite the fact that the Fed has now taken a neutral view? We assume so. Of course, Canada, too, is facing huge uncertainties for the outlook – such as the as yet unsolved trade conflict between the US and China as well as global growth concerns.

However, the BoC had started to hike interest rates later and more cautiously than the Fed, which reflected the much more immediate risk for the domestic economy as a result of the NAFTA renegotiations.

As a result, it still has some catching up to do. Most recently the BoC assumed that it still has scope for a few more cautious rate hikes until a neutral position is justified. Market participants are questioning this and are pricing in a further rate hike this year with only a small likelihood. So if the BoC once again confirms its expectations of further rate hikes CAD should benefit.

CAD OTC indications and options strategy:

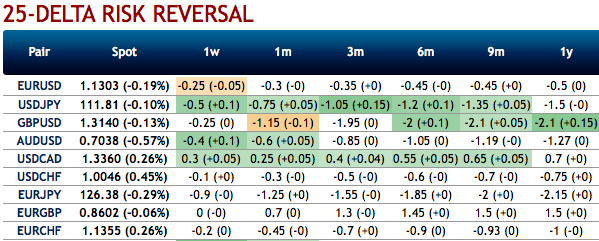

3M ATM IVs are trending a shy above 6.26% - 6.58%, skews are also suggesting the odds on OTM call strikes up to 1.36 levels at this juncture. We could also notice bullish neutral risk reversals that signal upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Thus, call spreads are preferred option structures given elevated skew and favorable cost reduction.

At spot reference: 1.3360 levels, we execute USDCAD 3m/1m call spread with strikes of 1.36/1.32 for a net debit.

Maintain the net delta of the position above 40% and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 36 levels (which is mildly bullish), while hourly USD spot index was at 118 (highly bullish) while articulating (at 11:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?