Since we maintain medium term bearish stance on this pair, while any abrupt short term upswings could also be utilized by below strategy.

In our opinion, although some price recoveries that we've been seeing from last couple of weeks, weekly and monthly chart signals us the medium to long term bearish trend.

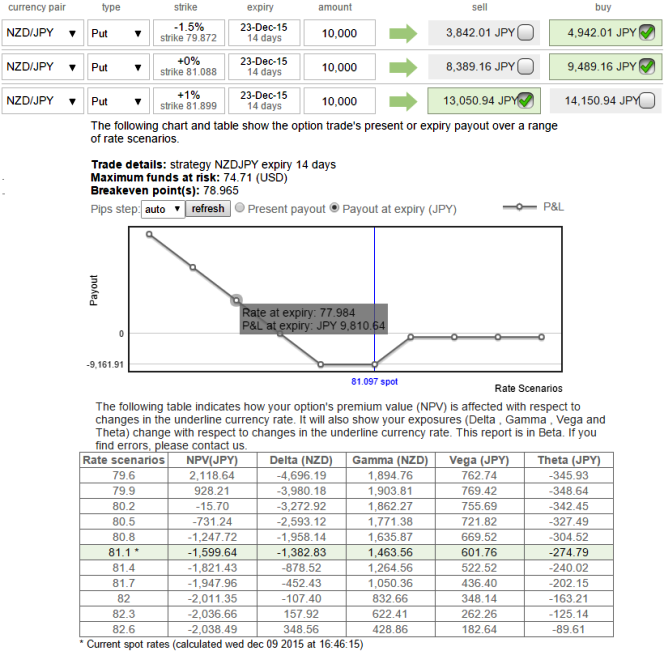

Currency Hedging Strategy: Use deep OTM put in NZD/JPY Short Put Ladder

With current spot FX at 81.078 levels, the strategy takes care of hedging motives in medium term basis.

Here goes the strategy this way with net delta at -0.13 with a motive to mitigate downside risks.

Short side of 1% ITM put option with shorter expiry is likely to mitigate any abrupt upswings in near term. Remember ITM options could always be at risk of exercise which is why we've kept smaller bracket on upside.

From then onwards we would await for the effectiveness of active longs on 15D ATM -0.51 delta put option and one more long position on 1M (-1.5%) OTM -0.29 delta put option.

Delta of all Out Of The Money (OTM) options will move towards zero. Therefore, on expiry day the premium of all Out Of The Money options becomes zero and they expire worthless. That's why we've used lengthier expiry on OTM side.

Please be noted that the expiries on all options shown in diagram are identical which is meant for demonstration purpose only.

FxWirePro: Put ladders to serve NZD/JPY hedging objectives again but use ITM puts on shorts and deep OTM puts on long

Wednesday, December 9, 2015 11:27 AM UTC

Editor's Picks

- Market Data

Most Popular