Notwithstanding the SNB's repeated assertions that the franc is “significantly overvalued", there is a little economic impact from said overvaluation. Even on the question of the franc’s valuation, one could derive different conclusions using either the PPP or FEER methodologies.

The Swiss National Bank’s (SNB) today and the Bank of Japan’s (BoJ) tomorrow morning. However, in both cases, it is almost completely certain that they will decide to “carry on”. Both have de facto reached the end of their expansionary possibilities (in the case of the SNB they may even have gone beyond that). As a result, they can both only come across as optimistic about inflation - similar to their colleagues in the US (see above) – and hope that they will sound more convincing than Ms. Yellen did yesterday.

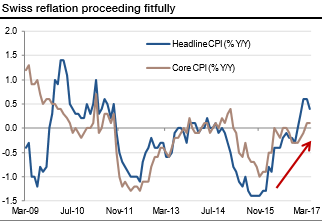

Gradual reflation: The Swiss current account is the largest among the G10 economies, and it has averaged over 10% of GDP in the past few years despite the franc's sharp appreciation. In terms of the broader economy, businesses are adapting to franc strength and the unemployment rate has been stable over the past year. CPI inflation readings have also been trending fitfully higher into positive territory since late 2015. Switzerland, therefore, appears to fit well within the broad European reflation story (refer above graph).

Persistent reserves accumulation. The uptrend in the Sight deposits of domestic banks indicates persistent SNB intervention to support the EURCHF since early 2015. The deposits have continued to rise despite a -0.75% interest rate levy. SNB intervention is confirmed by the persistent rise in Swiss foreign reserves, which are now the third largest in the world and growing (refer above graph).

SNB seems to be dependent on ECB to normalize first. The interest rate differential needs to turn higher in favor of the euro in order to alleviate the appreciation pressures on the franc. We thus expect the SNB to lag the ECB in taking steps towards policy normalization, which would argue for a gradually higher spot path for the EURCHF over the next several quarters from a broadly higher euro.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices