FX vols underwent through a bi-modal pattern since late February, rising sharply until around March 20th and dropping almost as steadily since then. The rise was associated with the “shock” component linked to the most acute phase of the COVID-19 crisis. Current valuations appear to be benignly pricing the economic follow-up to the health crisis. VXY-G10 pricing is less than 3vol pts from the mid-February all-time low.

This hints that the structural forces that triggered a broad- based reduction of FX vols over the past five years might now be back into play. The comparison of the average USD/G10 3m market vol with two exogenous drivers, equity and rates volatility, suggests FX vol to be undervalued vs US Equities but finds FX vols rich vs rates by around 2 vols.

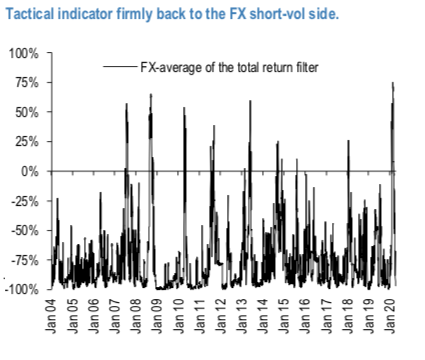

Indicative of the improved FX vol backdrop the tactical gamma trading indicator that relies on a slew of global risk sentiment indicators and currency specific vol surface indicators is firmly back into the FX short-vol territory (refer 1st chart). Consequently defensive vol positions find themselves in a hot seat but amid the political noise level rather than scrapping them we suggest a few risk premium harvesting strategies to alleviate the bleed.

As ATM vols are still sluggish (refer 2nd chart), tactical gamma indicator is firmly back into the FX short vol territory. Defensive vol positions are clearly feeling it. Rather than scrapping them we suggest alleviating the pain by adding risk harvesting legs. Courtesy: JPM

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data