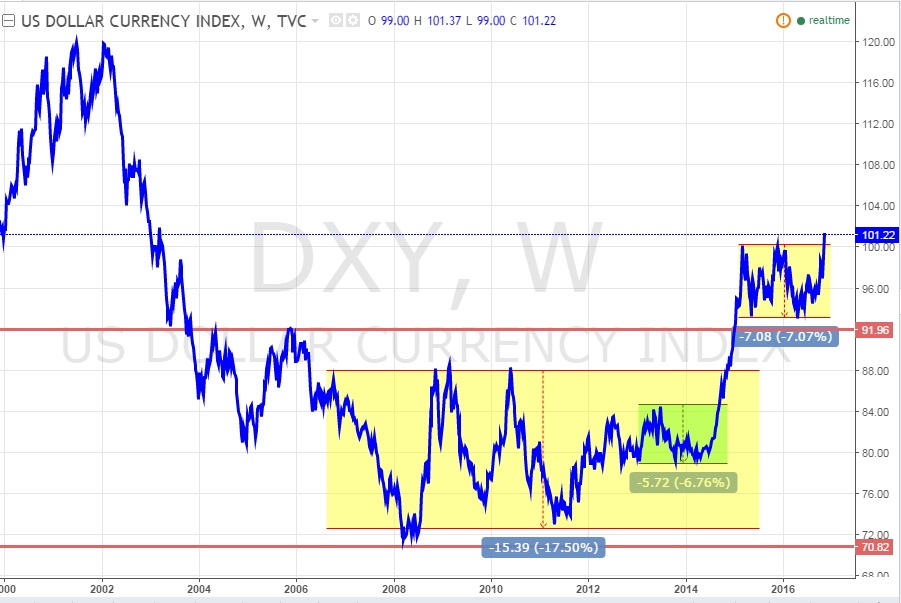

Over the past 9 days, the dollar had an amazing run, which we believe will continue. This is a beginning of a new trend in dollar, a trend that is in line with the broader trend that began back in 2011, on the onset of the European debt crisis, caused 2013 emerging market run, played its part in oil crash in 2015, and playing its role in USD/CNY exchange rate. This trend is a reversal of the downtrend that began in 2001 and ended in 2008. See chart 1, prepared in tradingview.com

In the past 9 days, the dollar index has risen by 3.94 percent; it’s the longest ever winning streak since 30th April 2012, when it rose for 14 consecutive days resulting in a net gain of 3.4 percent. The net gain in the current run is the highest since August 2008, when it gained 5.4 percent in 11 days of consecutive run.

The fundamentals are currently very positive for the dollar and we expect the run to continue. We strongly recommend buying at breakout and at dips.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX