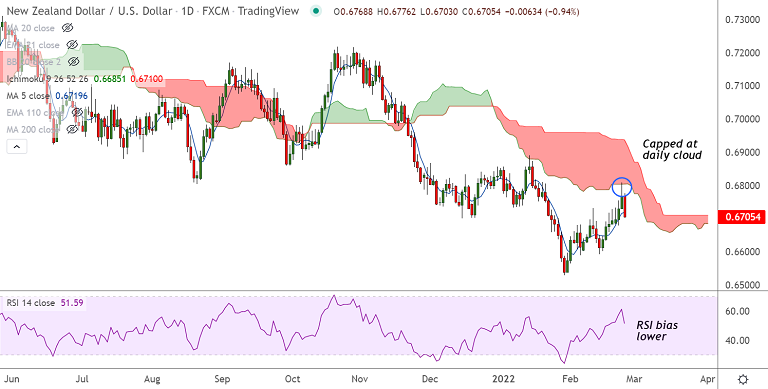

Chart - Courtesy Trading View

NZD/USD was trading 0.64% lower on the day at 0.6725 at around 06:20 GMT.

Russia-Ukraine war spooked investors and weighed on the risk averse antipodeans.

Russia's invasion of Ukraine triggered a fresh wave of the global risk-aversion trade. NATO confirmed that an official invasion of Ukraine has begun.

Upside in the pair was capped at daily cloud. Price action has slipped below 55-EMA.

The pair has erased gains above 200-week MA and was trading shy of 200H MA support. Breach below will drag the pair lower.

RSI is biased lower, but holds above 50 mark. 5-DMA is flat. Next major support is seen at 21-EMA at 0.6689.

On the flipside, daily cloud offers stiff resistance. Any further upside only on decisive break above.