The KRW has rallied significantly in the past three months; typically this would mean sharply lower implied vol and skew.

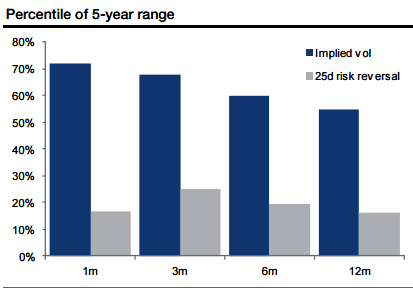

KRW implied vol (1m to 1y) is in the upper half of the 5-year range whereas 25d risk reversals are at the bottom end.

Risk reversals are a cheaper way to gain USDKRW upside exposure compared to owning USDKRW calls outright, especially with KRW strength looking a bit overextended.

Favour optionality to directional trades. We are inclined to position for a partial retracement of the down move through call spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Call spreads are preferred to vanilla structures given elevated skew and favourable cost reduction.

A 3m 25d delta risk reversal (1158/1068 strikes) costs 0.20% of USD notional. Alternatively, the strikes for a zero cost risk reversal are 1159/1076 respectively. Losses are unlimited below the lower strike.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?