In this write-up, we emphasize on staying short in USDCHF spot trades and short EURCHF put options. USDCHF turned elegantly lower towards the end of the week when the dollar lost ground against other reserve currencies in the lead-up to and the aftermath of the Section 301 investigation announcement.

The FX market seems to be gripped by springtime lethargy. Even though there are some plausible moves, such as a weaker euro following some cautious comments by ECB officials or the dollar easing slightly in reaction to disappointing US consumer confidence yesterday afternoon.

What drives the above-stated trades: Well, we maintain to uphold USDCHF shorts as a core long Europe position that has added cushion from resilience to trade-related jitters in equity markets and stealth tapering of the SNB balance sheet.

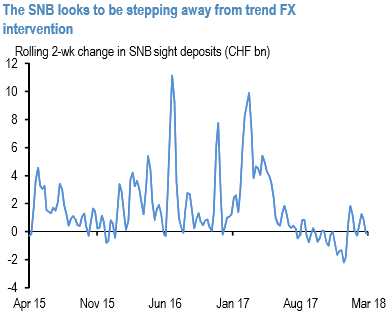

On the latter, SNB sight deposits have now declined CHF 4bn or 1% from their peak last August, and the SNB does seem to be stepping aside from trend FX intervention (refer 1st chart).

Cash CHF longs aside, the short-dated EUR put/CHF call we wish to sell with an intention of a part of a covered EURCHF short package to expire worthless and enable us to lock in the entire premium credit as the underlying spot FX likely to prolong its bullish travel.

Never forget to pick up tepid IVs (refer above nutshell evidencing for EURCHF ATM IVs, the least among G10 FX universe) in the slow pace of CHF appreciation over the past few months could have been more effectively monetized through covered option selling structures of this kind, or even better through USD put/CHF call spreads (refer 2nd chart).

The outperformance of out-of-the-money CHF call selling constructs is in part due to the market's long memory of the franc de-peg that keeps those options priced above historic norms and helps defray the material negative carry on cash positions.

We’ve already advocated shorts in USDCHF spot trade, we like to maintain the position with a strict stop at 0.9585. Marked at -1.45%.

Short a 1m 1.1775 (ATM strike) EURCHF put, received 29bp.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above -30 levels (bearish), while hourly USD spot index was at 67 (bullish), CHF at -133 (bearish) while articulating (at 12:36 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings