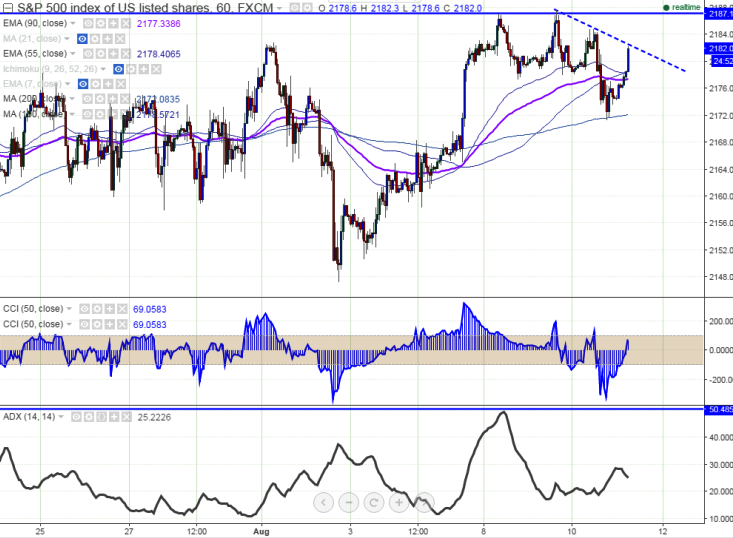

- Pattern formed – Double top

- Major resistance -2187 (Aug 8th 2016 high).

- Major intraday support – 2170 (200 HMA).

- The index erased some of the losses made yesterday after making a low of 2172. It is currently trading around 2180.

- The index has formed a temporary top around 2187 and any further bullishness only above that level. Any break above 2187 will take the index to next level till 2201 (161.8% retracement of 2120 and 1989)/2210 (161.8% retracement of 2182.5 and 2145).

- On the lower side, any break below 2170 will drag the pair till 2158/2145.

- Short term bullish invalidation only below 2145.

It is good to sell on rallies around 2187 with SL around 2205 for the TP of 2158/2146.