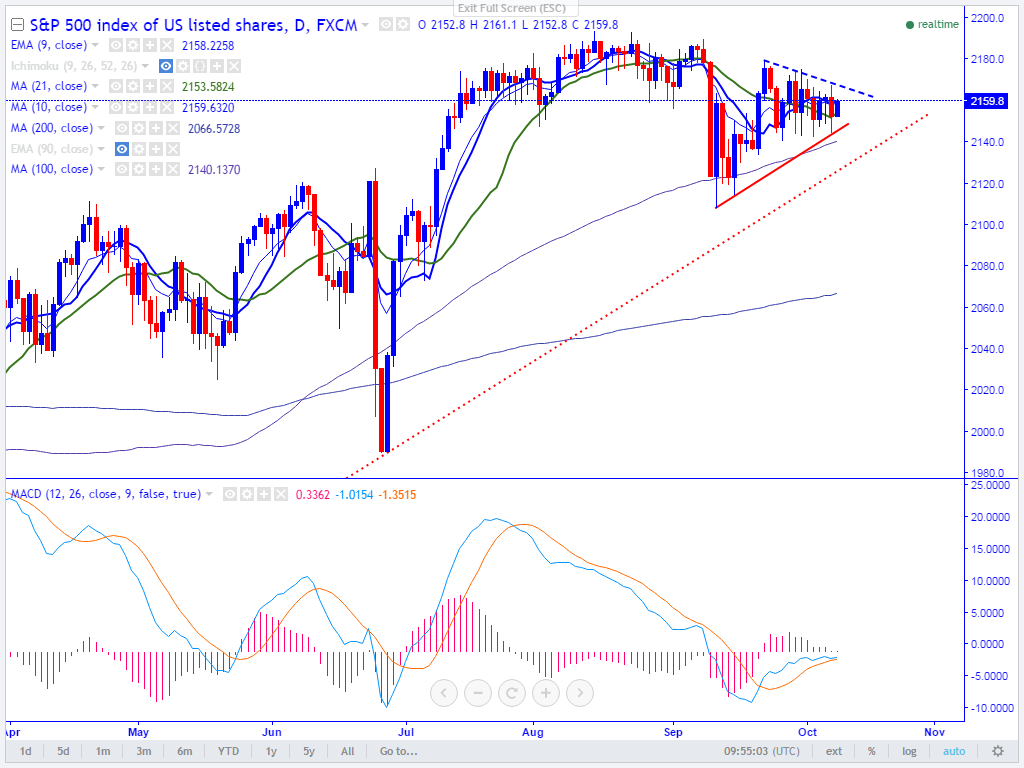

- Major Intraday resistance- 2168 (trend line joining 2179.90 and 2173.60).

- Major support – 2135 (61.8% retracement of 2108 and 2179.90).

- The index declined slightly after jumping till 2167.40 on Friday for the past two trading session. It is currently trading around 2155.50.

- On the lower side, the downside is capped by 61.8% retracement of 2108 and 2179.90 and any further downside till 2108 can happen only below 2135 level.

- The jump from the low of 2108 has been stopped at 2179.90 and any break above will take the pair further up till 2193.90/2205 in the short term. The minor resistance is around 2166.

It is good to sell on rallies around 2162-2165 with SL around 2180 for the TP of 2142/2110.