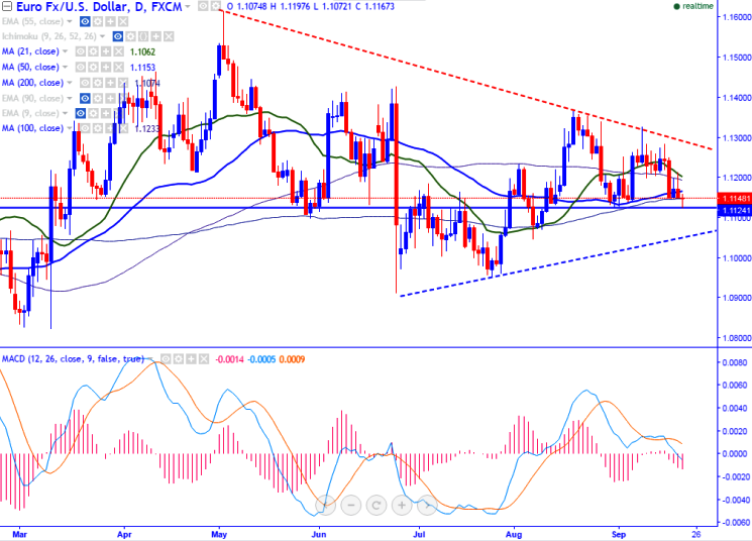

- Pattern formed- Triple bottom

- Major resistance – 1.1210 (21- day MA).

- The pair has broken 200-day MA at 1.1146 and declined till 1.11231 at the time of writing. It is currently trading around 1.11512.

- EUR/USD has formed a triple bottom around 1.11200 and any further weakness can be seen only below that level.

- Any break below 1.1120 will drag the pair further till 1.1045/1.100 in the short term.

- On the higher side, any break above 1.1164 (50- day MA) will take the EUR/USD to next immediate resistance at 1.1210/1.1245. Short term bullishness only above 1.12840 (Sep 15th high).

- Overall bullishness only above 1.13660.

It is good to sell only below 1.11200 with SL around 1.11650 for the TP of 1.1045/1.1000