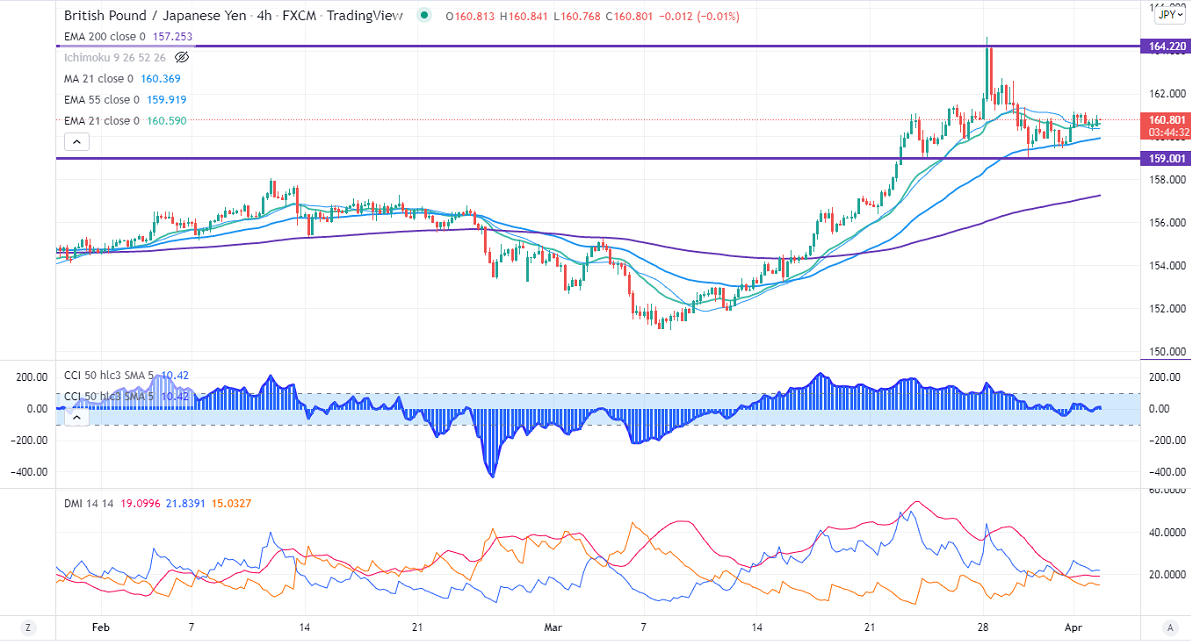

GBPJPY is trading higher for the second consecutive day and holding above 160. A minor weakness in the Japanese yen is supporting the pair at lower levels. The pound sterling consolidates in a narrow range between 1.31825 and 1.30858 for the past three days. Any breach below 1.310 confirms the intraday bearishness.

USDJPY

USDJPY surged to 123.03 after an upbeat Jobless rate. The US unemployment rate declined to 3.6% from the previous month's 3.7%. Intraday bullish continuation only if it breaks 123.20.

Technicals:

On the lower side, immediate support is around 160.40, breach below will drag the pair to the next level to 160/159.40/159. The minor resistance to be watched is around 161.20, break above that level confirms intraday bullishness, and a jump till 162/164 is possible.

It is good to sell on rallies 161.25-30 with SL around 162 for the TP of 158.