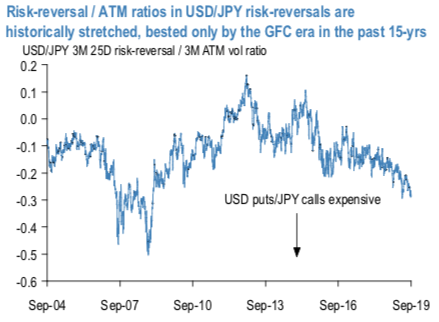

USDJPY risk-reversals have been persistently bid through the back half of last year and most of this, so much so that RR/ATM ratios have now reached levels reminiscent of GFC era extremes (in favor of JPY calls, refer 1st chart) despite nominal pricing of Yen options being orders-of- magnitude more benign today. It may be tempting to associate this apparent “distortion” with the risk-bearishness – and attendant hedging demand for Yen calls – brought about by the long-simmering US/China trade conflict. The reality is far more mundane however, and rooted in the currency hedging preferences of Japanese institutions and corporates as the Fed – BoJ policy rate gap widened over the past 12-18 months. Instead of incurring the steep negative carry of selling USDJPY forwards (to the tune of 250-300bp) to cover FX risks of USD receivables /US bond exposures, Yen buying flows have increasingly taken the form purchasing USD puts/JPY calls on risk-reversals that were judged to be relatively inexpensive vis-a-vis forwards.

Please be noted that the USDJPY positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 104.50 levels. This indicates hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand (refer 2nd figure).

While negative risk reversal numbers of short tenors show some mild positive shifts and broad-based hedging sentiments for the bearish risks remain intact across all tenors (3rd nutshell).

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Hence, at spot reference of USDJPY: 107.996 levels, we advocated buying a 2M/2w 109.732/105.50 put spread when Fed and BoJ monetary policies were scheduled (vols 6.78 vs 6.45 choice), the strategy has been functioning as predicted.

Hence, currently the underlying spot is trading at 106.80 (while articulating) we wish to uphold the two-legged strategy comprised of both ITM and OTM puts, wherein short leg is likely to function even if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. The lower/shrinking implied volatility is good for options writer and increasing realized volatility is good for the bearish trend. Courtesy: JPM, Sentry & Saxo

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation