EM Asia FX: We remain UW, albeit with reduced conviction. In this week’s update, we look at how our EM Asia FX sentiment gauges have evolved since the beginning of 2017.This is timely in our view given the generally more positive tone to EM Asia sentiment over this period. Sentiment levels, based off our measure, are at more neutral levels compared with the start of the year. The sentiment gauge is made up of 4 inputs:

1. Spot deviation from its own 200 day moving average;

2. Offshore equity flows (where data is available);

3. The difference between onshore and offshore forward points

4. Implied volatility from the options market.

Each input is standardized as a 3-month rolling Z score and the sentiment gauge is then taken as an unweighted average of these 4 inputs. Higher readings tend to indicate more positive USD sentiment and vice versa for lower readings.

For other currencies in SEA we have generally seen a move lower in the sentiment gauge, albeit not to the same degree as NEA.

The USDMYR sentiment gauge has fallen sharply but remains quite volatile due to shifts in the offshore NDF points. We have also seen a sharp move lower in the USDIDR sentiment gauge, although the shift in actual spot IDR has been quite modest. This may reflect the desire of the Indonesia authorities to maintain reserve accumulation and prevent significant IDR REER appreciation

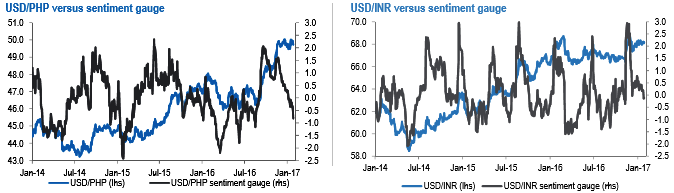

Interestingly, we have seen a meaningful correction lower in the USDPHP sentiment gauge; however, there has been very little follow through in terms of spot (refer above diagram).

We have seen NDF points move lower, while equity flows have been around flat month to date, which is an improvement on outflows seen in November and December of last year. The fact that this has not been reflecting in lower USDPHP spot levels could reflect similar dynamics to IDR or alternatively continued capital outflow pressures from the Philippines.

Finally, the USDINR sentiment gauge remains close to flat and is at the highest level within EM Asia (refer above diagram). Equity outflows have continued in January despite some improvement elsewhere in the region. Spot USDINR has also remained at elevated levels.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data