In just a week, markets went from doubting a March rate increase to viewing one as a sure bet. The central bank's top brass engineered the change by speaking in favor of a hike, culminating in Fed Chair Janet Yellen's endorsement on last Friday.

What changed to push central bank policy makers from the neutral stance that Fed-watchers saw in their January meeting minutes to the brink of a rate increase? Not much, if you're looking at U.S. data. The fact that nothing deteriorated was enough to clear the hurdle for a March rate move, especially because steady domestic data have come alongside a slowly-improving international outlook – a major shift from the situation at this time last year, when global risks helped to stay the Fed's hand.

The charts below illustrate the steady U.S. economy and sunnier international situation that have given policy makers the confidence to prime markets for a March 15 hike. As a result, you could see the reflections of underlying factors in OTC markets.

OTC Updates: Please be noted that the mounting hedging sentiments for all dollar crosses across different tenors, you can figure this out in nutshell showing risk reversals.

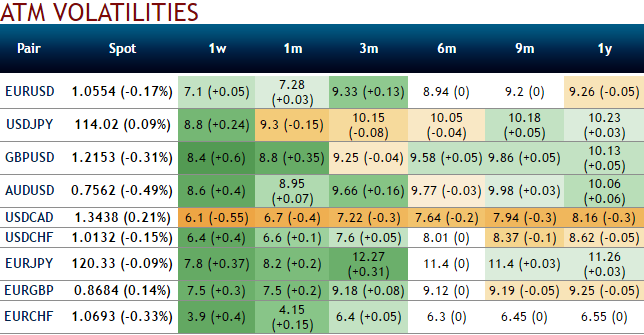

The implied volatility of ATM contracts of all dollar crosses are gaining traction across all tenors ahead of Fed monetary policies (see 1-3m tenors). This volatility observation is absolutely suitable for tenor selection in diagonal option spreads.

Rising negative flashes indicates active hedging sentiments for these downside risks and vice versa.

Acknowledge the gaining traction in the hedging sentiments of USD with higher negative risk reversals of dollar crosses versus euro, sterling, and Aussie dollar would imply dollar strength, while upside risks in dollar against Swiss franc, yen and Canadian dollar in long run is justifiable by positive flashes when you have to anticipate forwards rates and observe the spot curve of this pair (see IVs, RR nutshell, Sensitivities, and compare with spot prices).

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts