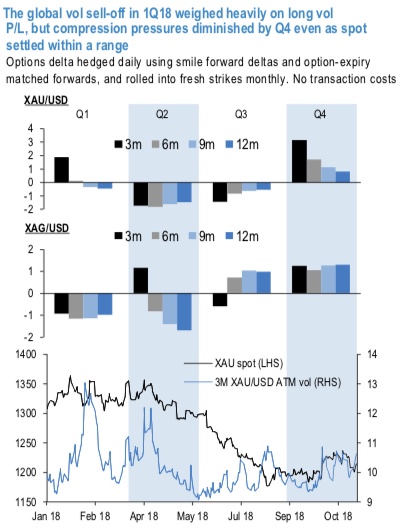

Despite a year packed with political risk, macro and market surprises gold vols underperformed much of the way before bottoming out at multi-decade lows in Q4.

Gamma briefly spiked in Q1 and Q4 (refer above chart), driven by a post-US wage inflation surprise/VIX shock in February and a sharp positioning correction in October, respectively.

The two idiosyncratic episodes had little impact outside of gamma tenors and did not durably alter the broad sideways trajectory of the option market through the year. The under-performance in options across strikes and tenors was the most pronounced during the 10% slide in prices in Q2. It is odd that de-leveraging and dollar strength of 2018 have been largely ignored by the precious metals vols, similar to the non-responsiveness of G7 FX vols.

Our prior analysis has shown that historically such price moves were worth 3-4 vol pts in 3M ATM vol. That makes the 1H gold underperformance especially notable.

Looking ahead, our analysts expect spot gold prices to remain fairly contained throughout 1H’19 (narrowly bearish in 1Q) before hitting the accelerator in 2H (15% gain by 2019YE), factoring in a recession risk in 2020 and a Fed pause with safe haven demand ahead of that – more details given in the section on Metals fundamentals.

On the face of it, the magnitude of projected price moves in 1H looks too small to be able to breathe much life into gold vols but if our analysts’ 2H forecasts realize (15% upside in 2H), gold vol should shoot up 5-6pts in the 2H. The magnitude of any potential vol rebound is clearly hostage to the extent of spot price moves.

Focusing on micro structure, we recently published a long/short gold gamma trading machine learning model that utilizes vols, option implied flow and risk sentiment in making near-term predictions about implied-realized gold vol performance (Big Data and AI Strategies: Machine Learning Approach to Trading Gold Volatility from Oct 19). Since May the model has been recommending to buy gold gamma vols.

The US 10yr treasury yield fell from 3.07% to 3.03%, while 2yr yields eked a slightly lower range of 2.80% - 2.82%. Fed fund futures continued to price the chance of the next rate hike on 19 December at 75%.

Hence, tactically, we added 2M XAUUSD straddles (financed by selling NZDUSD straddles) to our model portfolio about two weeks ago. The long/short structure minimizes time decay while maintaining the long gold gamma vol upside. The model flipped last week as skews sharply retraced and got bid in favor of XAU puts. For the time being gamma is continuing to perform. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -62 levels (which is bearish), hourly USD spot index was at 4 (neutral) while articulating at (11:30 GMT). For more details on the index, please refer below weblink:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings