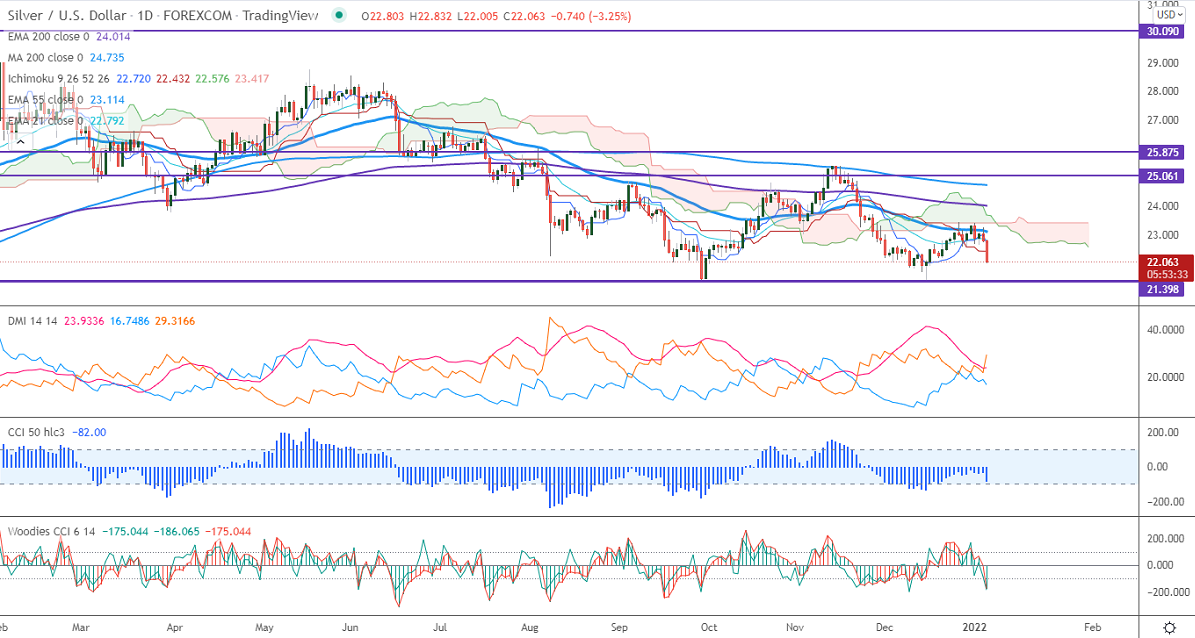

Ichimoku analysis (Daily chart)

Tenken-Sen- $23.01

Kijun-Sen- $22.43

Silver trades weak for the past two consecutive days on surging US Treasury yields. The Fed meeting minutes signaled for an earlier rate hike as expected. The tightening of monetary policy by major central banks puts pressure on precious metals. It hits a low of $21.42 and is currently trading around $21.618.

The number of people who have filed for unemployment benefits rose by 7000 to 207000 previous week compared to a forecast of 200K. The US ISM services have fallen to 62 in Dec vs 66.90.

Technically, silver is trading slightly below 21 and 55- day EMA, this confirms major bearishness. A dip to $21.42/$20.89/$20 is possible. The near-term resistance is at $22.63, with surge targets of $$23/$23.25. Significant bullish continuation only if it breaks $23.50.

Indicator (Daily chart)

CCI (50) –Bearish

Directional movement index – Neutral

It is good to sell on rallies around $22.55-60 with SL around $23.30 for TP of $20.