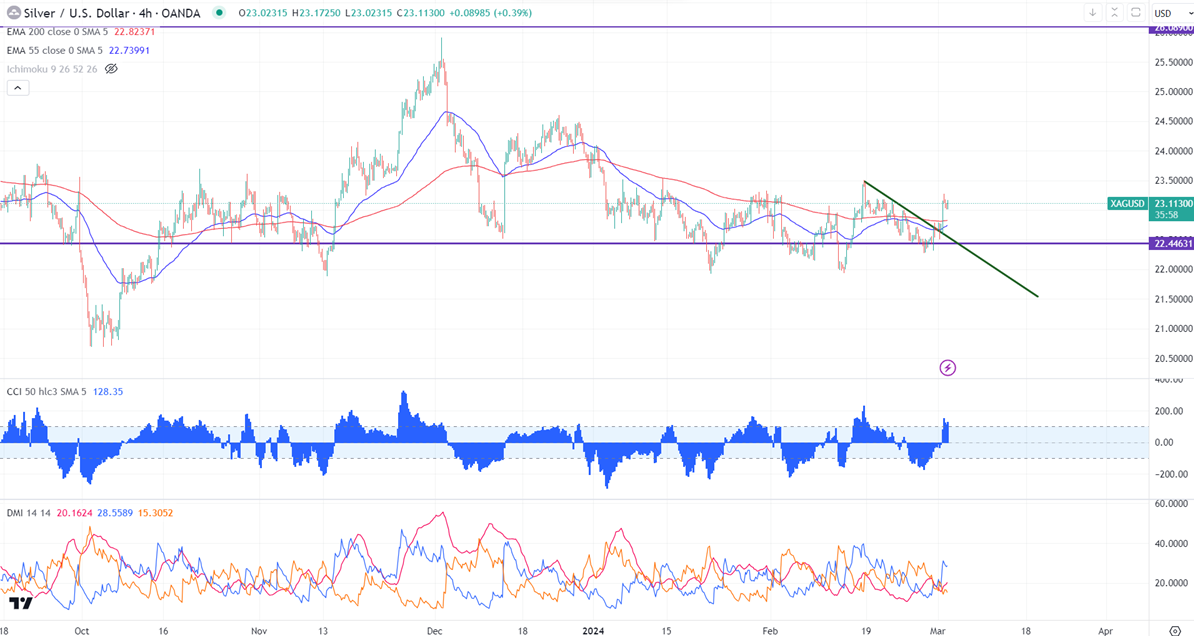

Ichimoku analysis (4- hour chart)

Tenken-Sen- $22.55

Kijun-Sen- $22.61

Silver jumped sharply following the footsteps of gold. The weak US ISM manufacturing PMI dragged the US dollar index further down below the 104 level. The precious metals broke the bearish channel resistance of $22.70-72. Any breach above $23.60 will push the Silver price to $24/$24.60.

Economic Indicator-

US ISM PMI- below estimate (Positive for Silver)

Gold-silver ratio-

Gold/Silver ratio- Above 90. It indicates silver is at the oversold level and expected to outperform Gold. It is good to buy silver vs gold.

Major trend reversal level -$23.60.

It trades below 21, 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $22.75 and a break below targets of $22.25/$21.90/$21.40/$20.68.