Silver-

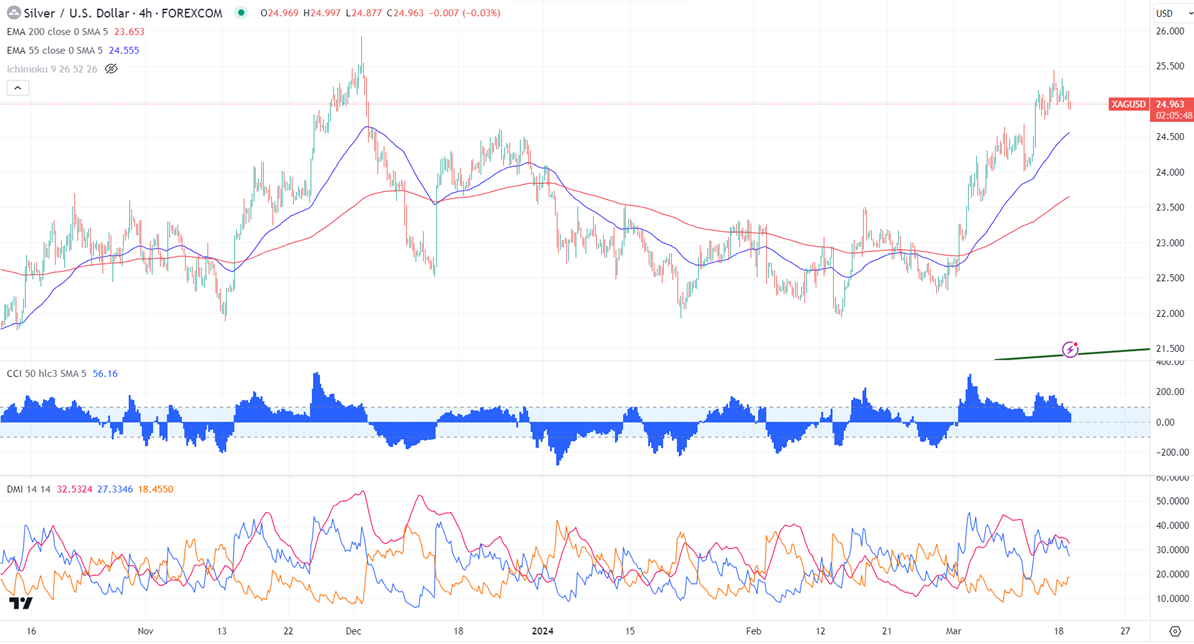

Ichimoku analysis (4- hour chart)

Tenken-Sen- $25.11

Kijun-Sen- $24.76

The Silver lost its shine on strong US dollar buying. The result of decreasing hopes of the Fed early rate cut, putting pressure on Silver at lower levels. It hit a low of $24.87 and is currently trading around $24.97.

BOJ ended eight years of negative interest rates and kept its uncollateralized overnight call rate to remain around 0 to 0.10%.

Gold-silver ratio-

Gold/Silver ratio- 86.31. It shows that one ounce of gold is equivalent to 85.90 ounces of silver. It is good to buy silver at lower levels compared to gold.

Major trend reversal level -$25.50

It trades above 21, 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $24.90 and a break below the targets of $24.40/$24/$23.60. On the higher side, immediate resistance is around $25.50, any breach above targets is $26/$27.

It is good to buy on dips around $24.45-50 with SL around $24 for TP of $25.80.