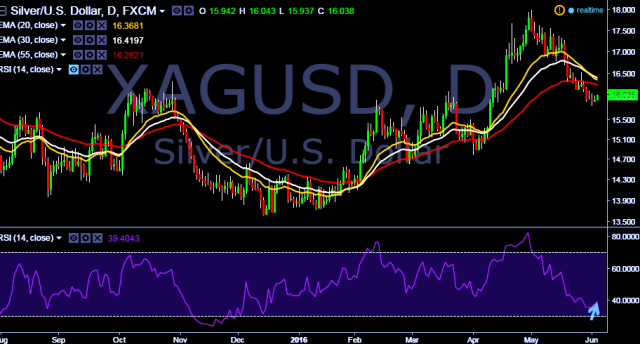

- XAG/USD is currently trading around $16.02 marks.

- It made intraday high at $16.03 and low at $15.93 levels.

- Intraday bias remains bullish till the time pair holds key support at $15.88 marks.

- A daily close below $15.88 will take the parity down towards key support at $15.62(20D EMA) marks.

- Alternatively, current upside trend will take the parity higher towards key resistances at $16.04, $16.11, $16.25 and $16.45 marks respectively.

- Important to note here that in a daily chart, 20D, 30D and 55D EMA heads up and confirms bullish trend.

- Later today, U.S. will release NFP job data, trade balance, factory orders and ISM non-manufacturing.

We prefer to take long position in XAG/USD around $16.02, stop loss $15.88 and target $16.11/ $16.25 marks.