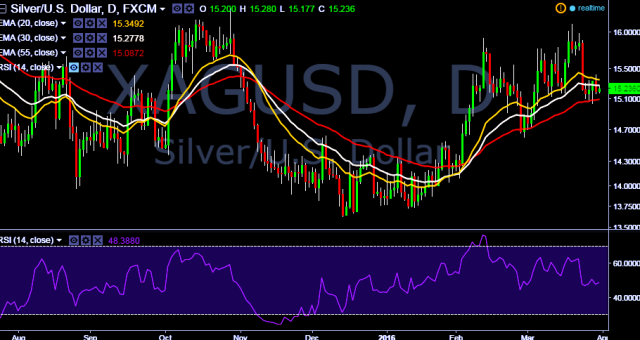

- XAG/USD is currently trading around $15.24 levels.

- It made intraday high at $15.28 and low at $15.17 levels.

- Intraday bias remains bullish for the moment.

- A daily close below $15.17 will tests key supports at $15.01, $14.94 and $14.55 marks respectively.

- Alternatively, a current rebound from $15.17 will likely to test key resistances at $15.42/ $15.60 and $15.72 marks.

- Important to note here that, 20D, 30D and 55D EMA heads up, which confirms bullish trend.

- Later today, US will release Chicago PMI data. This will provide further directions to the parity.

We prefer to tale long position in XAG/USD around $15.20, stop loss $15.03 and target $15.42 levels.