- XAG/USD is currently trading around $16.92 marks.

- It made intraday high at $16.94 and low at $16.82 levels.

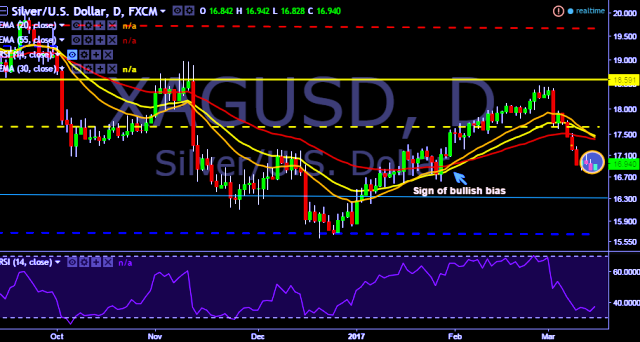

- Intraday bias remains neutral till the time pair holds key support at $16.84 mark.

- A daily close above $16.84 will test key resistances at $17.03/$17.12/$17.27/$17.35/$17.52/$17.62/$17.76/$17.96/$18.01/$18.22/$18.48/$18.88 marks respectively.

- On the other side, a daily close below $16.84 will take the parity down towards key supports at $16.65/$16.48/$16.36/$16.23/$15.85 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart. Current downside movement is short term trend correction only.

We prefer to go long on XAG/USD around $16.90 with stop loss at $16.78 and target of $17.03/$17.12.