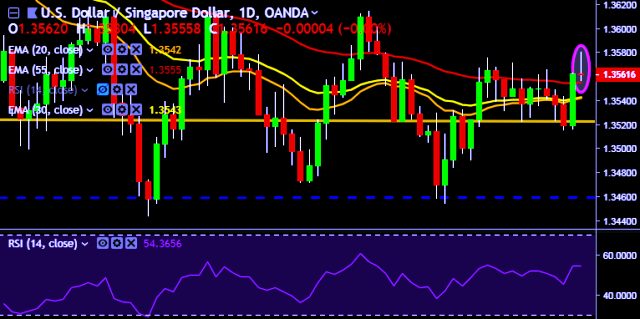

- USD/SGD is currently trading around 1.3560 marks.

- It made intraday high at 1.3580 and low at 1.3555 levels.

- Intraday bias remains bullish till the time pair holds key support at 1.3538 mark.

- A daily close above 1.3562 will test key resistances at 1.3590, 1.3615 and 1.3672 marks respectively.

- Alternatively, a consistent close below 1.3562 will drag the parity down towards key supports at 1.3538, 1.3490, 1.3422, 1.3378 and 1.3315 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- Singapore Q1 2019 GDP flash qq increase to 2 % (forecast 1.2 %) vs previous 1.4 %.

- Singapore Q1 2019 GDP advance yy decrease to 1.3 % (forecast 1.5 %) vs previous 1.9 %.

- MAS says Singapore's GDP growth is expected to come in slightly below mid-point of 1.5-3.5% forecast range in 2019.

- Singapore Central bank - MAS will therefore maintain the current rate of appreciation of the S$neer policy band.

We prefer to take long position on USD/SGD around 1.3560, stop loss at 1.3522 and target of 1.3590.

FxWirePro: Singapore dollar remains volatile after Central banks’s statements, GDP data

Friday, April 12, 2019 1:36 AM UTC

Editor's Picks

- Market Data

Most Popular