We stay OW EM FX. In EMEA EM, we hold long RUB & TRY v. short ZAR, In EM Asia, we hold OW MYR and short USDSGD. G10 vols fell and EM vols rose during this week’s dollar shakeout, but decoupling is unlikely to sustain. Asian FX (INR, IDR, and KRW) vols are most susceptible to mean-reversion lower in EM, while GBP-vols look cheap in G10.

But in this write-up, we emphasize a quantitative and graphical representation of the volatility market among the EMFX space. We run you through in qualitative directional views for three currency pairs. Directional views in vol space.

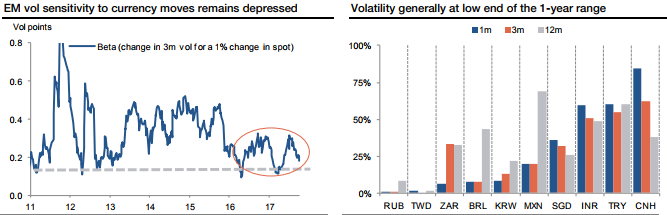

Despite the recent EMFX weakness, implied vol remains at the low end of its one-year range, while the gap between implied and realized vols is at the upper end of the range.

Vol and skew beta: The sensitivity of average EM implied vol and risk reversals to changes in underlying spot rates remains depressed.

Value: Based on the position of volatility to its one-year range and carry costs, volatility is particularly cheap in the RUB but expensive in INR.

KRW: Absent a severe escalation in tension or a worst-case scenario unfolding, volatility should be contained, the year-to-date range (1109/1161) should hold, and, as such, fading the risk premium in limited loss structures such as DNT is appealing.

INR: We’ve already advocated shorts on this pair in our recent post, fading the recent depreciation and selling volatility in a limited loss structure (if bond outflows reverse it could be very negative) is preferred over outright short USDINR NDF. We recommend a USDINR 3m put strike 65 with a knock-out at 63.5.

TRY: Vol, skew, and convexity are not expensive versus recent history. Investors that are concerned that the diplomatic row coupled with deterioration in fundamentals could spark a large depreciation/spike in volatility, could consider a USDTRY 3m one touch knock-in 4.35. Courtesy: SG

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate