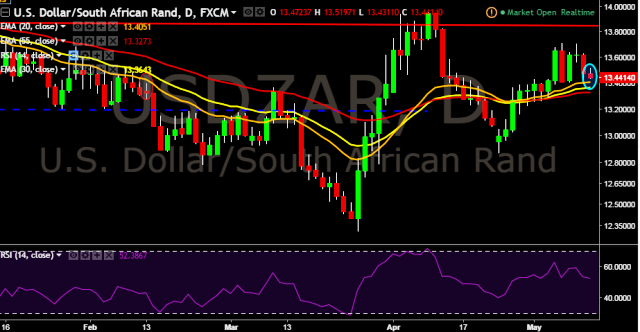

- USD/ZAR is currently trading around 13.43 levels.

- It made intraday high at 13.51 and low at 13.43 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 13.63 marks.

- A daily close above 13.47 will take the parity higher towards key resistances around 13.63, 13.70, 13.95, 14.16, 14.29, 14.50, 14.75, 14.96, 15.05, 15.28 and 15.45 marks respectively.

- Alternatively, a daily close below 13.47 will drag the parity down towards key supports at 13.40, 13.25, 13.12, 12.95, 12.70, 12.48, 12.30, 12.22 and 12.14 levels respectively.

We prefer to take short position in USD/ZAR around 13.45, stop loss at 13.63 and target of 13.38/13.26.