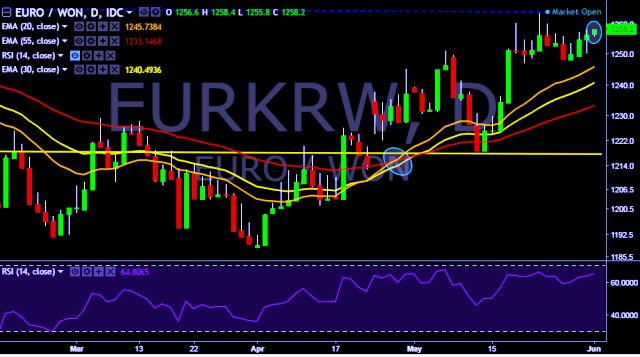

- EUR/KRW is currently trading around 1,257 mark.

- Pair made intraday high at 1,258 and low at 1,255 levels.

- Intraday bias remains slightly bullish till the time pair holds key support at 1,247 mark.

- A daily close below 1,256 will drag the parity down towards key supports around 1,247, 1,242, 1,234, 1,225, 1,218, 1,207, 1,200, 1,194, 1,189, 1,178, 1,163 and 1,154 marks respectively.

- Alternatively, a sustained close above 1,256 will take the parity higher towards key resistances around 1,263, 1,274, 1,287 and 1,304 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- South Korea’s May Nikkei Markit manufacturing PMI decrease to 49.2 vs previous 49.4.

- South Korea’s May trade balance prelim decrease to 5.99 bln $ vs previous 12.98 bln $.

- South Korea’s May export growth prelim decrease to 13.4 % (forecast 13.6 %) vs previous 24.1 %.

- South Korea’s May import growth prelim increase to 18.2 % (forecast 14.6 %) vs previous 17.3 %.

We prefer to take long position in EUR/KRW around 1,256, stop loss 1,247 and target of 1,263/1,274.