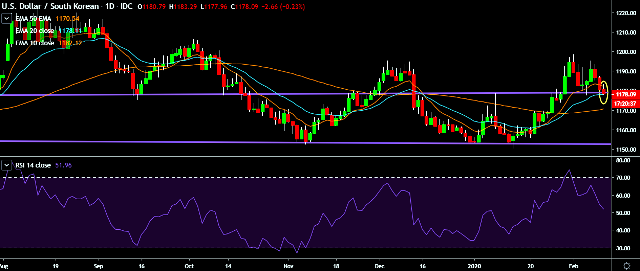

- EUR/KRW is currently trading around 1,178 mark.

- It made intraday high at 1,183 and low at 1,177 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 1,185 mark.

- A sustained close above 1,185 will take the parity higher towards key resistances around 1,194, 1,203, 1,212, 1,227 and 1,240 marks respectively.

- On the other side, a daily close below 1,180 will drag the parity down towards key supports around 1,168, 1,157, 1,138, 1,122 and 1,100 marks respectively.

- Important to note here that 20D, 30D and 55D EMA up and confirms the bullish trend in a daily chart.

- South Korea’s kospi was trading 0.52 pct higher at 2,234.87 points.

- Fitch Ratings has affirmed Korea's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'AA-' with a Stable Outlook.

We prefer to take short position on USD/KRW around 1,180, stop loss at 1,203 and target of 1,157/1,138.