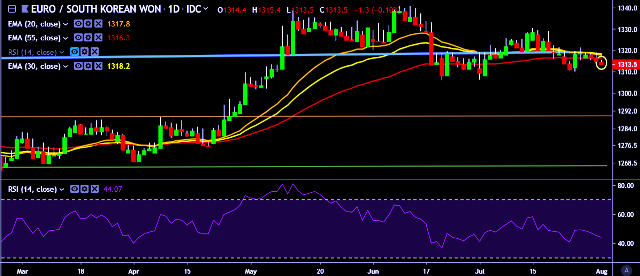

- EUR/KRW is currently trading around 1,313 mark.

- It made intraday high at 1,315 and low at 1,313 levels.

- Intraday bias remains neutral till the time pair holds key support at 1,310 mark.

- A sustained close above 1,318 will take the parity higher towards key resistances around 1,328, 1,340, 1,358, 1,363, 1,377 and 1,392 marks respectively.

- On the other side, a daily close below 1,310 will drag the parity down towards key supports around 1,302, 1,294, 1,287, 1,278 and 1,268 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- South Korea’s Kospi was trading 0.40 pct lower at 2,016.45 points.

- South Korea July CPI m/m at -0.3 pct vs -0.2 pct previous release.

- South Korea Nikkei manufacturing PMI 47.3 vs 47.5 previous release.

- South Korea July Trade balance 0.00B vs 2.4B previous release.

We prefer to take short position on EUR/KRW only below 1,310, stop loss 1,322 and target of 1,287.

FxWirePro: South Korean won trades flat after CPI, manufacturing PMI data

Thursday, August 1, 2019 1:05 AM UTC

Editor's Picks

- Market Data

Most Popular