AUD/USD is still stuck in its 0.70/0.7380 range, mirroring the lack of direction in front-end AU-US rate spreads.

We think the spread could narrow from both sides over the next 3m, pushing AUD/USD lower.

Our forecasts for two more rate cuts from the RBA in H1 2016 though there is a higher risk now that those cuts are delayed.

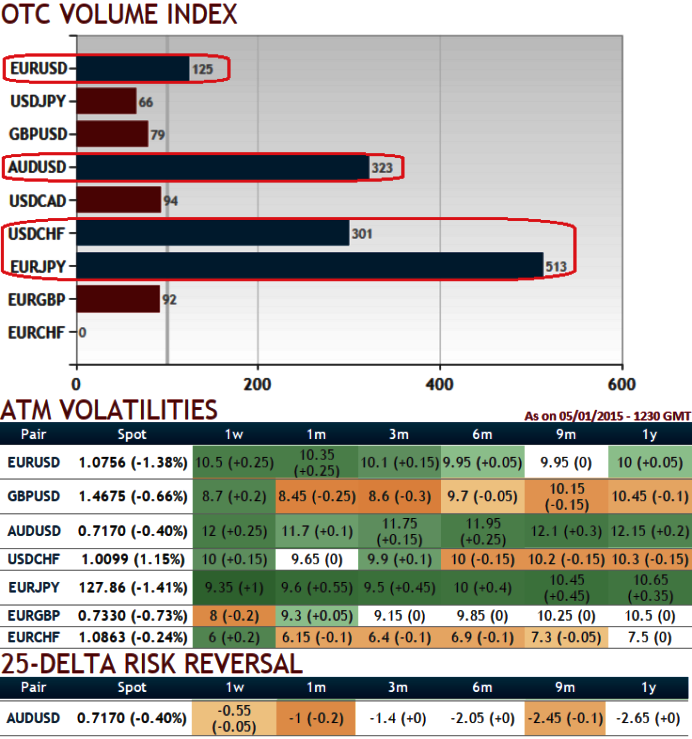

As you can observe the pairs from the diagram as the OTC volumes rise the implied volatility for near month at the money contracts also rises, AUDUSD pair has been best instance and remained as the highest among G20 currency segment and is seen at 11.7-12% levels for 1m expiry.

We could still foresee the AUD biased lower over the next 3-6 months on the back of modest near term softness in commodity prices and Fed tightening (Q1 of 16 target USD 0.67) (see hedging markets positions in OTC markets over the period).

Whereas volume index for EURCHF and GBPUSD in contrast evidence tepid volatilities implied in the OTC market.

25- Delta risk reversal attributes the premiums of AUDUSD puts and calls on the most liquid OTM contracts due the difference vols, which in turn divulge the relative costliness of the downside protection for the underlying spot FX, so we can anticipate next underlying market downward direction with help of these negative numbers.

Before finding some support later in the year (Q4 of 16 target USD 0.70 back again) as the terms of trade trough and the domestic economy continues to rotate away from mining-related activity.

FxWirePro: Spiking AUD/USD OTC volumes propel IVs, while risk reversals signals downswings

Wednesday, January 6, 2016 10:41 AM UTC

Editor's Picks

- Market Data

Most Popular